Focus on Data Security

In an era where data breaches are increasingly common, the employment screening-services market in South America is witnessing a heightened emphasis on data security. Companies are becoming more aware of the potential risks associated with handling sensitive information during the screening process. As a result, there is a growing demand for services that ensure compliance with data protection regulations. The employment screening-services market is adapting by implementing advanced security measures, which not only protect candidate information but also build trust with clients. This focus on data security is likely to drive market growth as organizations prioritize safeguarding personal data.

Expansion of Remote Work

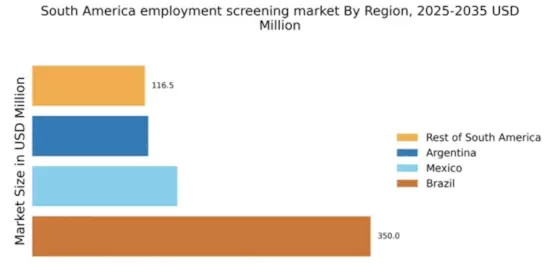

The expansion of remote work arrangements in South America is reshaping the employment screening-services market. As more companies embrace flexible work models, the need for comprehensive background checks for remote employees has intensified. Employers are increasingly aware of the importance of verifying the credentials of candidates who may not be physically present in the office. This trend is driving demand for screening services that cater specifically to remote hiring processes. The employment screening-services market is thus evolving to meet these new requirements, ensuring that organizations can confidently hire remote talent while maintaining high standards of security and compliance.

Rising Employment Opportunities

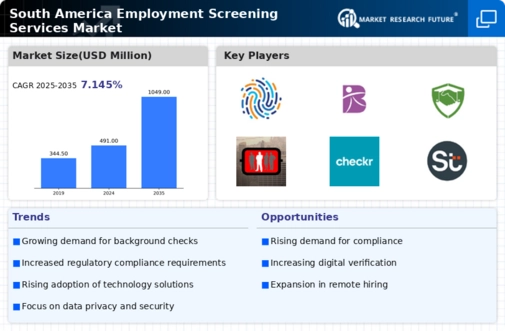

The employment screening-services market in South America is experiencing growth due to an increase in job opportunities across various sectors. As companies expand, the need for thorough background checks becomes paramount to ensure the integrity of potential hires. In 2025, the region's unemployment rate is projected to decrease to approximately 8%, indicating a robust job market. This trend compels employers to utilize screening services to mitigate risks associated with hiring unqualified candidates. The employment screening-services market is thus positioned to benefit from this rising demand, as organizations seek to enhance their hiring processes and maintain a competitive edge.

Integration of AI and Automation

The integration of artificial intelligence (AI) and automation technologies is transforming the employment screening-services market in South America. These innovations streamline the screening process, making it more efficient and cost-effective. By automating background checks and utilizing AI algorithms, companies can process applications faster and with greater accuracy. This technological shift is expected to enhance the overall quality of screening services, thereby attracting more clients. The employment screening-services market is likely to see increased adoption of these technologies, as businesses strive to improve their hiring practices and reduce operational costs.

Growing Awareness of Employee Rights

There is a rising awareness of employee rights in South America, which is influencing the employment screening-services market. As workers become more informed about their rights, companies are compelled to adopt fair and transparent hiring practices. This shift encourages organizations to utilize screening services that comply with labor laws and ethical standards. The employment screening-services market is thus adapting to these changes by offering services that not only meet legal requirements but also promote a positive workplace culture. This trend is likely to foster trust between employers and employees, ultimately benefiting the market.