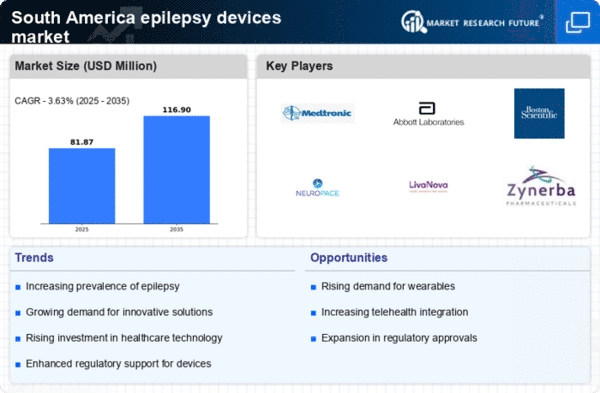

Rising Prevalence of Epilepsy

The increasing prevalence of epilepsy in South America is a crucial driver for the epilepsy devices market. Recent estimates indicate that approximately 1.5 million individuals in the region are affected by epilepsy, leading to a growing demand for effective management solutions. This rising patient population necessitates the development and distribution of advanced epilepsy devices, which can monitor and manage seizures more effectively. As awareness of epilepsy improves, more patients are seeking treatment options, thereby expanding the market. The epilepsy devices market is likely to experience significant growth as healthcare providers and patients alike recognize the importance of innovative devices in improving quality of life and reducing the burden of this neurological disorder.

Advancements in Wearable Technology

The rapid advancements in wearable technology are transforming the epilepsy devices market in South America. Wearable devices, such as smartwatches and fitness trackers, are increasingly being integrated with seizure detection capabilities. These innovations allow for real-time monitoring of patients, providing critical data that can be shared with healthcare professionals. The market for wearable epilepsy devices is projected to grow at a CAGR of around 15% over the next five years, driven by consumer demand for more accessible and user-friendly solutions. The epilepsy devices market is adapting to these technological changes, as manufacturers focus on enhancing device functionality and user experience, ultimately leading to better patient outcomes.

Regulatory Support for Medical Devices

Regulatory support for medical devices in South America is emerging as a key driver for the epilepsy devices market. Governments are implementing policies that facilitate the approval and distribution of innovative medical technologies, including epilepsy devices. This supportive regulatory environment encourages manufacturers to invest in research and development, leading to the introduction of new and improved products. The epilepsy devices market is likely to see accelerated growth as a result of these favorable regulations, which aim to enhance patient safety and access to effective treatment options. As regulatory frameworks continue to evolve, the market may experience increased competition and innovation.

Growing Awareness and Education Initiatives

The growing awareness and education initiatives surrounding epilepsy in South America are pivotal for the epilepsy devices market. Campaigns aimed at educating the public about epilepsy and its management are gaining traction, leading to increased recognition of the need for effective treatment options. As more individuals become informed about the condition, the demand for epilepsy devices is likely to rise. The epilepsy devices market is responding to this trend by developing targeted marketing strategies and educational programs that highlight the benefits of using advanced devices for seizure management. This heightened awareness could potentially lead to a more informed patient population, ultimately driving market growth.

Increased Investment in Healthcare Infrastructure

The ongoing investment in healthcare infrastructure across South America is a significant driver for the epilepsy devices market. Governments and private entities are allocating substantial funds to improve healthcare facilities and access to medical technologies. This investment is expected to enhance the availability of epilepsy devices, making them more accessible to patients in both urban and rural areas. As healthcare systems evolve, the epilepsy devices market is likely to benefit from improved distribution channels and increased awareness among healthcare providers about the importance of these devices in managing epilepsy effectively. This trend may lead to a more robust market presence for epilepsy devices in the region.