Increasing Energy Security

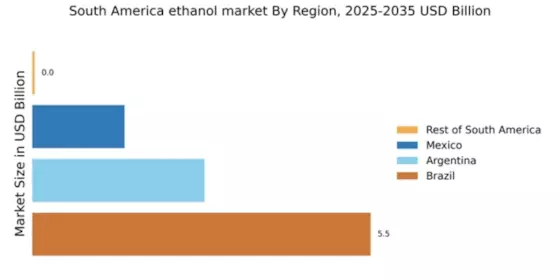

The drive towards energy independence is a crucial factor influencing the ethanol market in South America. Countries in the region are increasingly focusing on reducing their reliance on imported fossil fuels. Ethanol, derived from local agricultural products, offers a viable alternative that enhances energy security. For instance, Brazil, a leading producer, has seen its ethanol production reach approximately 30 billion liters annually, significantly contributing to its energy mix. This trend is likely to continue as governments promote policies that favor renewable energy sources. The ethanol market is thus positioned to benefit from this shift, as local production not only meets domestic energy needs but also reduces vulnerability to global oil price fluctuations.

Rising Agricultural Output

The growth in agricultural productivity in South America plays a pivotal role in shaping the ethanol market. With advancements in farming techniques and crop yields, the availability of feedstock for ethanol production has increased. For example, Brazil's sugarcane production has expanded, providing a robust supply for ethanol conversion. In 2025, the region's sugarcane harvest is projected to exceed 600 million tons, facilitating a more sustainable and cost-effective ethanol production process. This increase in agricultural output not only supports the ethanol market but also enhances the economic viability of rural areas, creating jobs and stimulating local economies.

Consumer Preferences for Renewable Energy Sources

The shift in consumer preferences towards renewable energy sources is a notable driver of the ethanol market in South America. As awareness of environmental issues grows, consumers are increasingly seeking sustainable alternatives to fossil fuels. This trend is reflected in the rising demand for ethanol-blended fuels, particularly in Brazil, where over 70% of new vehicles are compatible with ethanol. The ethanol market is thus experiencing a transformation, as producers adapt to meet the changing preferences of consumers. This consumer-driven demand is expected to bolster the growth of the ethanol sector, encouraging further investments and innovations.

Technological Innovations in Production Processes

Technological advancements in the production of ethanol are significantly impacting the market dynamics in South America. Innovations such as improved fermentation techniques and enzyme applications are enhancing the efficiency of ethanol production. These advancements not only reduce production costs but also increase the yield of ethanol from feedstock. In 2025, it is estimated that the adoption of these technologies could lead to a 15% increase in production efficiency within the ethanol market. As producers embrace these innovations, they are likely to gain a competitive edge, positioning themselves favorably in both domestic and international markets.

Environmental Regulations and Sustainability Initiatives

The implementation of stringent environmental regulations in South America is driving the ethanol market towards more sustainable practices. Governments are increasingly mandating the use of biofuels to reduce greenhouse gas emissions and combat climate change. For instance, Brazil's National Biofuels Policy aims to increase the share of biofuels in the energy matrix, with a target of 27% by 2030. This regulatory framework encourages investment in the ethanol market, as producers seek to comply with environmental standards while meeting consumer demand for cleaner energy sources. The focus on sustainability is likely to enhance the competitiveness of ethanol against traditional fossil fuels.