Rising Cyber Threats

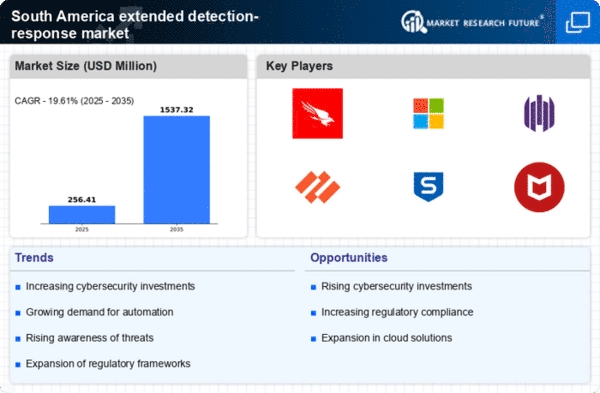

The extended detection-response market in South America is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are facing a surge in ransomware attacks, phishing schemes, and data breaches, which necessitate robust security measures. In 2025, it is estimated that cybercrime could cost businesses in the region upwards of $150 billion annually. This alarming trend compels companies to invest in advanced detection and response solutions to safeguard their digital assets. As a result, the extended detection-response market is likely to see a significant uptick in demand as businesses prioritize cybersecurity to mitigate risks and protect sensitive information.

Growing Awareness of Cybersecurity

There is a notable increase in awareness regarding cybersecurity among businesses in South America, which is positively influencing the extended detection-response market. Companies are beginning to recognize the potential financial and reputational damage that cyber incidents can inflict. This heightened awareness is prompting organizations to allocate more resources towards cybersecurity initiatives. In 2025, it is projected that spending on cybersecurity solutions in the region will reach approximately $10 billion, reflecting a growth rate of around 12% annually. Consequently, the extended detection-response market is poised to benefit from this trend as organizations seek comprehensive solutions to enhance their security posture.

Regulatory Pressures and Compliance

Regulatory pressures are significantly impacting the extended detection-response market in South America. Governments are implementing stricter regulations regarding data protection and cybersecurity, compelling organizations to enhance their security measures. Compliance with regulations such as the General Data Protection Regulation (GDPR) and local data protection laws is becoming increasingly critical. Failure to comply can result in substantial fines and legal repercussions. In 2025, it is anticipated that compliance-related spending in the cybersecurity sector will increase by 20%, driving demand for extended detection-response solutions. This trend indicates that the extended detection-response market will likely see growth as organizations strive to meet regulatory requirements and protect sensitive data.

Demand for Integrated Security Solutions

The extended detection-response market in South America is being driven by the demand for integrated security solutions that provide comprehensive protection against cyber threats. Organizations are increasingly seeking solutions that combine various security functions, such as endpoint detection, network monitoring, and threat intelligence, into a single platform. This trend is indicative of a shift towards a more holistic approach to cybersecurity. In 2025, the market for integrated security solutions is expected to grow by 15%, highlighting the potential for the extended detection-response market to capitalize on this demand. As businesses strive for efficiency and effectiveness in their security strategies, the integration of multiple security capabilities becomes essential.

Shift to Remote Work and Digital Transformation

The shift to remote work and ongoing digital transformation initiatives are contributing to the growth of the extended detection-response market in South America. As organizations adapt to new work environments, they are increasingly reliant on digital tools and cloud services, which can introduce new vulnerabilities. This transition necessitates enhanced security measures to protect remote access points and sensitive data. In 2025, it is projected that remote work will account for 30% of the workforce in the region, further emphasizing the need for robust cybersecurity solutions. Consequently, the extended detection-response market is likely to expand as businesses seek to secure their digital infrastructures in this evolving landscape.