Increasing Allergy Incidence

The rising incidence of allergies in South America is a crucial driver for the eye allergy-treatment market. Studies indicate that approximately 30% of the population in urban areas experiences allergic reactions, with eye allergies being particularly prevalent. This trend is attributed to environmental factors such as pollution and climate change, which exacerbate allergen exposure. As a result, there is a growing demand for effective treatments, including antihistamines and corticosteroids. The eye allergy-treatment market industry is responding to this need by expanding product offerings and enhancing accessibility. Furthermore, the increasing awareness of allergy management among healthcare professionals and patients is likely to contribute to market growth, as more individuals seek appropriate treatments for their symptoms.

Growth of E-commerce Platforms

The expansion of e-commerce platforms is transforming the distribution landscape of the eye allergy-treatment market industry in South America. With the increasing penetration of the internet and mobile devices, consumers are turning to online shopping for their healthcare needs. This shift is particularly evident in the purchase of over-the-counter allergy medications, which are now more accessible through various online channels. Market data indicates that online sales of allergy treatments are projected to grow by 15% annually. This trend not only provides convenience for consumers but also allows for competitive pricing and a broader selection of products. As e-commerce continues to thrive, it is likely to play a crucial role in shaping the future of the eye allergy-treatment market.

Rising Awareness and Education

The growing awareness and education regarding eye allergies and their treatments are pivotal for the eye allergy-treatment market industry. Public health campaigns and educational initiatives by healthcare organizations are informing individuals about the symptoms and management of eye allergies. This increased awareness is leading to higher consultation rates with healthcare providers, which in turn drives demand for effective treatments. Market analysis indicates that the consumer segment is becoming more proactive in seeking solutions, with a notable increase in inquiries about over-the-counter options. As patients become more informed, the market is likely to see a shift towards personalized treatment plans, further propelling growth in the industry.

Regulatory Support for New Treatments

Regulatory support for the approval of new treatments is a significant driver for the eye allergy-treatment market industry in South America. Regulatory agencies are increasingly streamlining the approval process for innovative therapies, which encourages pharmaceutical companies to invest in research and development. This supportive environment is crucial for bringing new products to market, particularly those that address specific needs in allergy management. The eye allergy-treatment market industry is likely to benefit from this trend, as faster approvals can lead to a wider variety of treatment options for consumers. Additionally, the collaboration between regulatory bodies and industry stakeholders may enhance the overall quality and safety of new therapies.

Advancements in Pharmaceutical Research

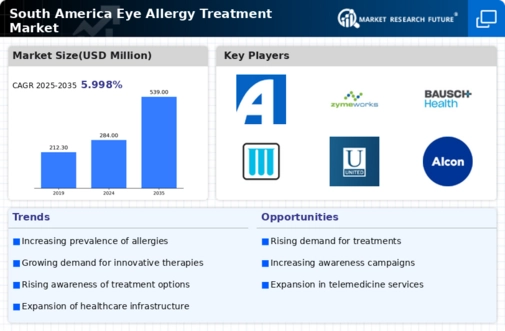

Innovations in pharmaceutical research are significantly impacting the eye allergy-treatment market industry in South America. The development of new drug formulations and delivery systems has led to more effective treatments with fewer side effects. For instance, the introduction of novel biologics and targeted therapies is changing the landscape of allergy management. Market data suggests that the segment for prescription medications is expected to grow at a CAGR of 5% over the next five years. This growth is driven by the increasing investment in research and development by pharmaceutical companies, aiming to address unmet medical needs in allergy treatment. As these advancements continue, they are likely to enhance patient outcomes and drive market expansion.