Surge in Data Traffic

The surge in data traffic across South America is another critical driver influencing the fiber optic-components market. With the proliferation of digital services, streaming platforms, and cloud computing, data consumption has skyrocketed. Reports indicate that data traffic in the region is expected to grow by over 30% annually, necessitating the need for more efficient and high-capacity transmission solutions. Fiber optic technology, known for its high bandwidth capabilities, is increasingly being adopted to manage this growing demand. As businesses and consumers alike seek faster and more reliable internet services, the fiber optic-components market is likely to experience substantial growth. This trend suggests that companies involved in the production and distribution of fiber optic components may find lucrative opportunities as they cater to the escalating requirements of data transmission.

Emergence of 5G Technology

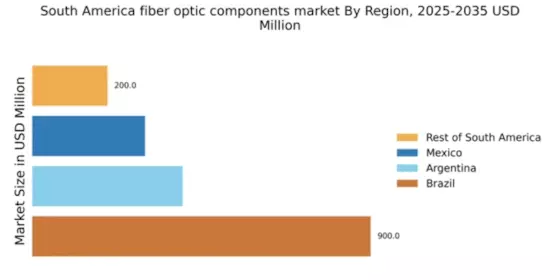

The emergence of 5G technology in South America is anticipated to be a transformative driver for the fiber optic-components market. As telecommunications providers prepare for the rollout of 5G networks, the demand for high-speed, low-latency connections is becoming increasingly critical. Fiber optic technology is essential for supporting the infrastructure required for 5G, as it provides the necessary bandwidth and speed. Countries like Brazil and Argentina are investing heavily in 5G trials and infrastructure development, which is expected to create substantial opportunities for the fiber optic-components market. The integration of fiber optics with 5G technology suggests a synergistic relationship that could lead to exponential growth in the demand for fiber optic components, as the region transitions to next-generation telecommunications.

Rising Adoption of Smart Cities

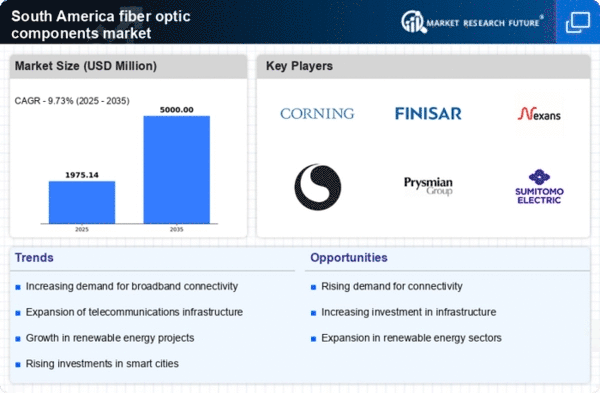

The rising adoption of smart city initiatives across South America is poised to significantly impact the fiber optic-components market. As urban areas strive to enhance efficiency and sustainability, the integration of smart technologies necessitates robust communication networks. Fiber optic components are essential for supporting the infrastructure required for smart city applications, such as traffic management, public safety, and environmental monitoring. Cities like Santiago and Buenos Aires are investing in fiber optic networks to facilitate these advancements. The fiber optic-components market is likely to see increased demand as municipalities prioritize the deployment of high-speed connectivity solutions to support their smart city projects. This trend indicates a growing recognition of the importance of fiber optics in creating interconnected urban environments.

Expansion of Telecommunications Infrastructure

The ongoing expansion of telecommunications infrastructure in South America appears to be a primary driver for the fiber optic-components market. Governments and private entities are investing heavily in modernizing and expanding their networks to meet the increasing demand for high-speed internet. For instance, Brazil has allocated approximately $1 billion for the development of fiber optic networks, which is expected to enhance connectivity in rural and underserved areas. This investment is likely to stimulate growth in the fiber optic-components market, as more infrastructure necessitates the deployment of advanced components. Furthermore, as urbanization continues to rise, the need for robust telecommunications systems becomes more pronounced, thereby driving demand for fiber optic solutions. The fiber optic-components market is poised to benefit significantly from these infrastructural developments, as they create a conducive environment for the adoption of fiber optic technologies.

Increased Focus on Telecommunications Security

Increased focus on telecommunications security in South America is emerging as a significant driver for the fiber optic-components market. As cyber threats become more sophisticated, the need for secure communication channels is paramount. Fiber optic technology offers inherent advantages in terms of security, as it is less susceptible to interception compared to traditional copper cables. Governments and enterprises are increasingly recognizing the importance of secure data transmission, leading to investments in fiber optic infrastructure. For example, Colombia has initiated projects aimed at enhancing cybersecurity measures within its telecommunications framework, which includes the deployment of fiber optic components. This heightened emphasis on security is likely to propel the fiber optic-components market forward, as organizations seek to safeguard their communications against potential threats.