Government Initiatives and Funding

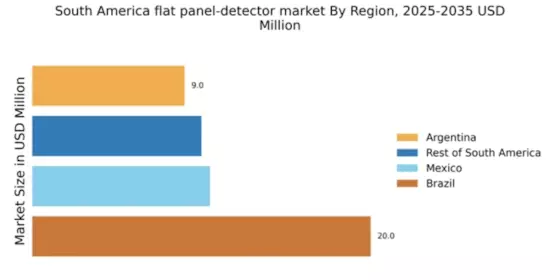

Government initiatives aimed at improving healthcare infrastructure in South America are significantly impacting the flat panel-detector market. Various countries in the region are allocating substantial budgets to modernize medical facilities and enhance diagnostic services. For instance, Brazil and Argentina have introduced funding programs to support the acquisition of advanced medical imaging equipment. This financial backing is expected to boost the adoption of flat panel detectors, as healthcare providers seek to upgrade their technology. The market is likely to benefit from these initiatives, with an anticipated growth rate of around 7% over the next few years, as investments in healthcare technology continue to rise.

Rising Demand for Diagnostic Imaging

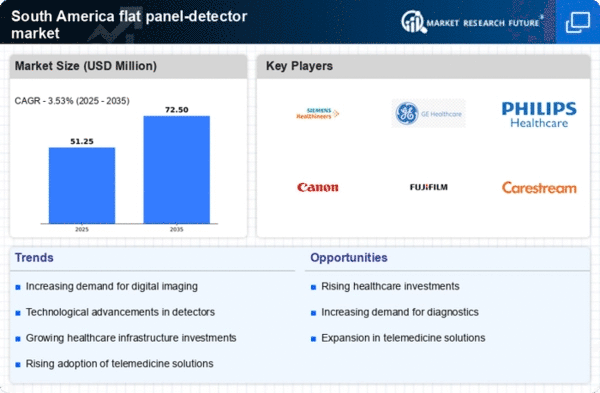

The flat panel-detector market in South America is experiencing a notable increase in demand for diagnostic imaging solutions. This surge is primarily driven by the growing prevalence of chronic diseases and the need for early detection. According to recent data, the incidence of conditions such as cardiovascular diseases and diabetes is on the rise, necessitating advanced imaging technologies. Hospitals and clinics are increasingly adopting flat panel detectors due to their superior image quality and efficiency. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the critical role of these devices in enhancing diagnostic capabilities within the healthcare sector.

Expansion of Medical Imaging Facilities

The expansion of medical imaging facilities in South America is a crucial driver for the flat panel-detector market. As healthcare access improves, more diagnostic centers are being established, particularly in urban and semi-urban areas. This expansion is accompanied by a growing need for advanced imaging technologies, including flat panel detectors, which are favored for their compact design and high-quality output. The market is likely to see a growth rate of approximately 7% as new facilities are equipped with state-of-the-art imaging solutions. This trend reflects a broader commitment to enhancing healthcare delivery and accessibility across the region.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare systems across South America is fostering growth in the flat panel-detector market. Innovations such as artificial intelligence and machine learning are being incorporated into imaging processes, enhancing the capabilities of flat panel detectors. These technologies improve diagnostic accuracy and operational efficiency, making them increasingly attractive to healthcare providers. As hospitals and clinics adopt these integrated solutions, the demand for flat panel detectors is expected to rise. The market could witness a growth trajectory of around 9% over the next few years, as the healthcare sector embraces digital transformation.

Growing Awareness of Preventive Healthcare

There is a marked increase in awareness regarding preventive healthcare in South America, which is positively influencing the flat panel-detector market. As populations become more health-conscious, there is a greater emphasis on regular health check-ups and screenings. This trend is leading to an uptick in the demand for advanced imaging technologies, including flat panel detectors, which facilitate accurate and timely diagnoses. The market is expected to expand as healthcare providers respond to this shift by integrating more sophisticated imaging solutions into their services. Projections indicate a potential market growth of approximately 6% in the coming years, driven by this heightened focus on preventive measures.