Expansion of Retail Networks

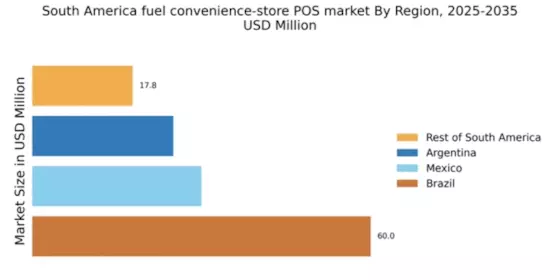

The expansion of retail networks across South America is a critical driver for the fuel convenience-store-pos market. As more convenience stores open in urban and rural areas, the demand for efficient POS systems increases. This expansion is often accompanied by strategic partnerships with fuel suppliers, enhancing the overall customer experience. Retailers are focusing on optimizing their supply chains and inventory management through advanced POS solutions. Recent statistics indicate that the number of convenience stores in South America has grown by 25% in the last three years, suggesting a strong market potential for innovative POS systems tailored to the fuel convenience-store-pos market.

Government Regulations and Compliance

Government regulations play a pivotal role in shaping the fuel convenience-store-pos market in South America. Compliance with local laws regarding fuel pricing, taxation, and environmental standards necessitates the implementation of sophisticated POS systems. Retailers must ensure that their systems can accurately track sales and generate reports that meet regulatory requirements. Additionally, as governments push for more transparency in fuel pricing, the demand for POS solutions that provide detailed analytics is likely to increase. Recent legislative changes have prompted many retailers to upgrade their systems, indicating a growing awareness of the importance of compliance in the fuel convenience-store-pos market.

Rising Fuel Prices and Consumer Behavior

In South America, fluctuating fuel prices significantly impact consumer behavior, thereby influencing the fuel convenience-store-pos market. As fuel prices rise, consumers tend to seek convenience and efficiency in their purchasing decisions. This shift drives the demand for POS systems that can facilitate quick transactions and provide loyalty rewards. Retailers are increasingly investing in technology that allows them to offer promotions and discounts, which can attract price-sensitive customers. Data suggests that a 15% increase in fuel prices correlates with a 20% rise in the use of loyalty programs at convenience stores, highlighting the importance of adapting to consumer needs in the fuel convenience-store-pos market.

Technological Advancements in POS Systems

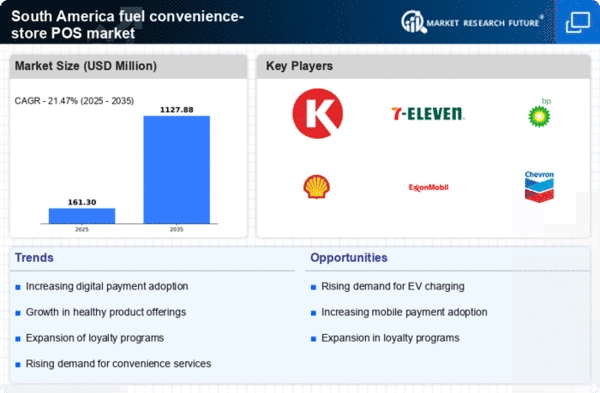

The fuel convenience-store-pos market in South America is experiencing a notable shift due to rapid technological advancements in point-of-sale (POS) systems. These innovations enhance transaction efficiency and customer experience, which is crucial in a competitive landscape. For instance, the integration of cloud-based solutions allows for real-time data analytics, enabling retailers to make informed decisions. Furthermore, the adoption of advanced security features, such as EMV compliance, is becoming increasingly important as consumers demand safer payment options. According to recent data, the market for POS systems in South America is projected to grow at a CAGR of 10% over the next five years, indicating a robust demand for modernized systems in the fuel convenience-store-pos market.

Consumer Preference for Contactless Payments

The growing consumer preference for contactless payment methods is reshaping the fuel convenience-store-pos market in South America. As consumers prioritize speed and convenience, retailers are compelled to adopt POS systems that support contactless transactions. This trend is particularly evident among younger demographics, who are more inclined to use mobile wallets and NFC technology. Data indicates that contactless payments accounted for approximately 30% of all transactions in the region in 2025, reflecting a significant shift in payment behavior. Retailers that adapt to this trend by upgrading their POS systems are likely to enhance customer satisfaction and drive sales in the fuel convenience-store-pos market.