Surge in Surgical Procedures

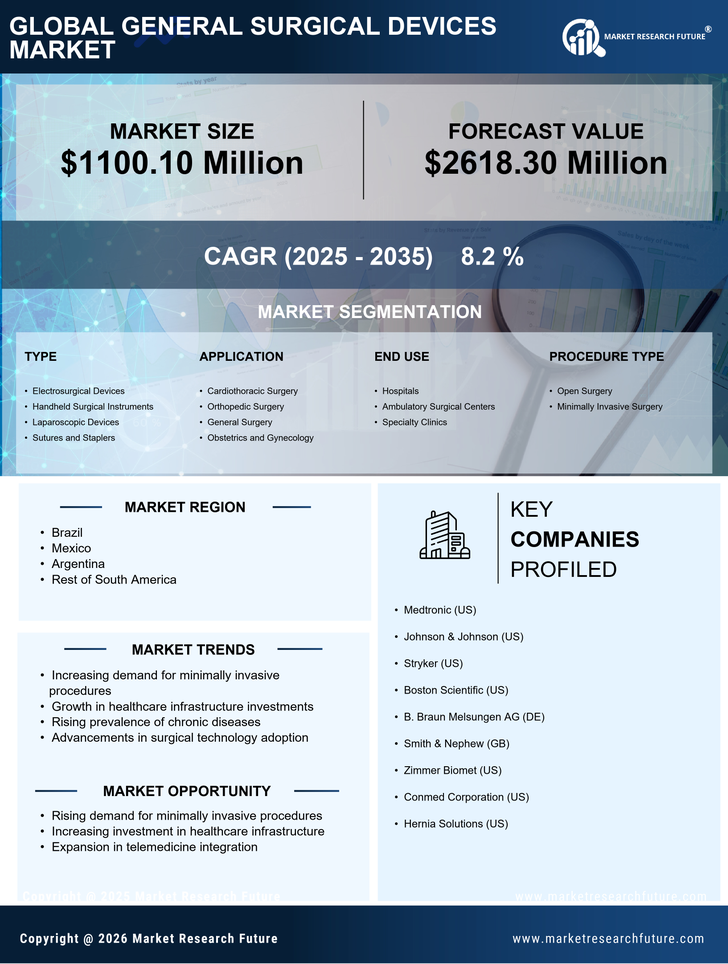

The surge in surgical procedures across South America is significantly impacting the general surgical-devices market. With an increasing population and a growing prevalence of surgical conditions, the demand for surgical interventions is on the rise. In 2025, it is estimated that the number of surgical procedures performed in South America will exceed 10 million annually, driven by factors such as an aging population and advancements in surgical techniques. This increase necessitates a corresponding rise in the availability of surgical devices, thereby propelling market growth. Hospitals and surgical centers are likely to invest in state-of-the-art devices to improve patient outcomes and operational efficiency, further enhancing the general surgical-devices market.

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the general surgical-devices market. Governments and private sectors are allocating more funds towards healthcare infrastructure, which includes the procurement of advanced surgical devices. In 2025, healthcare spending in South America is projected to reach approximately $500 billion, reflecting a growth rate of around 5% annually. This increase in investment is likely to enhance the availability and accessibility of surgical devices, thereby stimulating market growth. Furthermore, as healthcare facilities upgrade their equipment to meet modern standards, the demand for innovative surgical devices is expected to rise. This trend indicates a robust market environment for manufacturers and suppliers in the general surgical-devices market.

Rising Awareness of Surgical Options

Rising awareness of surgical options among patients is emerging as a significant driver for the general surgical-devices market in South America. As educational initiatives and health campaigns proliferate, patients are becoming more informed about their surgical choices and the benefits of various procedures. This heightened awareness is likely to lead to an increase in elective surgeries, as patients seek timely interventions for their health issues. In 2025, it is anticipated that elective surgeries will account for over 30% of all surgical procedures in the region. This trend not only boosts the demand for surgical devices but also encourages healthcare providers to enhance their offerings, thereby positively impacting the general surgical-devices market.

Growing Demand for Minimally Invasive Surgery

The growing demand for minimally invasive surgery (MIS) is a crucial driver for the general surgical-devices market in South America. Patients increasingly prefer procedures that offer reduced recovery times and lower risks of complications. As a result, healthcare providers are adopting MIS techniques, which require specialized surgical devices. The market for minimally invasive surgical devices is projected to grow at a CAGR of 7% through 2025, reflecting the shift towards less invasive procedures. This trend not only enhances patient satisfaction but also reduces healthcare costs associated with longer hospital stays. Consequently, the general surgical-devices market is likely to see a surge in the development and adoption of innovative devices tailored for MIS.

Technological Integration in Surgical Practices

The integration of advanced technologies in surgical practices is transforming the general surgical-devices market in South America. Innovations such as robotic-assisted surgery, augmented reality, and artificial intelligence are enhancing surgical precision and outcomes. In 2025, the market for robotic surgical systems is expected to reach $1 billion, indicating a growing acceptance of these technologies among healthcare providers. This technological evolution is likely to drive demand for compatible surgical devices, as hospitals seek to improve their surgical capabilities. Furthermore, the adoption of telemedicine and remote surgical consultations is expected to expand the reach of surgical services, thereby influencing the general surgical-devices market positively.