Increased Focus on Quality Assurance

An increased focus on quality assurance within the healthcare sector is shaping the healthcare regulatory-affairs-outsourcing market in South America. Regulatory agencies are placing greater emphasis on ensuring that products meet stringent quality standards before they reach consumers. This shift is particularly evident in the medical device industry, where compliance with ISO standards is critical. As a result, companies are outsourcing regulatory affairs to ensure that their products adhere to these quality benchmarks. The healthcare regulatory-affairs-outsourcing market is likely to benefit from this trend, as organizations seek to mitigate risks associated with non-compliance. The emphasis on quality assurance is expected to drive a growth rate of around 10% in the outsourcing market over the next few years, as firms prioritize regulatory compliance to maintain their market positions.

Rising Consumer Awareness and Advocacy

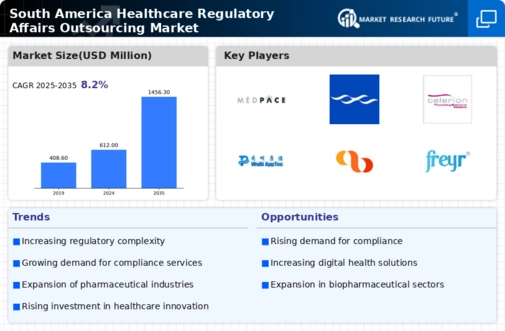

Rising consumer awareness and advocacy regarding healthcare products are influencing the healthcare regulatory-affairs-outsourcing market in South America. As patients become more informed about their rights and the safety of medical products, there is an increasing demand for transparency and accountability from manufacturers. This trend is prompting companies to prioritize compliance with regulatory standards to maintain consumer trust. The healthcare regulatory-affairs-outsourcing market is likely to see growth as organizations seek external expertise to ensure that their products meet the expectations of informed consumers. This shift towards greater accountability may drive a market growth rate of approximately 8% in the coming years, as firms recognize the importance of aligning their regulatory strategies with consumer advocacy efforts.

Growing Demand for Compliance Expertise

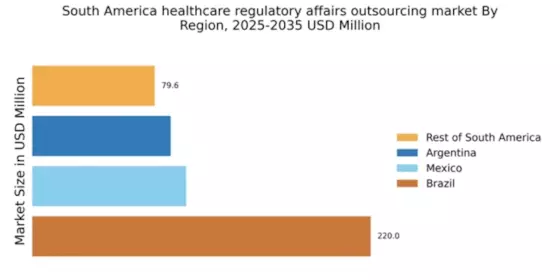

The healthcare regulatory-affairs-outsourcing market in South America is experiencing a notable increase in demand for compliance expertise. As regulatory frameworks evolve, companies are seeking specialized knowledge to navigate complex requirements. This trend is particularly pronounced in Brazil and Argentina, where regulatory bodies have intensified scrutiny on pharmaceutical and medical device approvals. The market for regulatory affairs outsourcing is projected to grow at a CAGR of approximately 12% over the next five years, driven by the need for companies to ensure compliance with local regulations. This growing demand for compliance expertise is likely to propel the healthcare regulatory-affairs-outsourcing market, as organizations increasingly rely on external partners to manage regulatory submissions and maintain compliance with evolving standards.

Technological Advancements in Regulatory Processes

Technological advancements are playing a pivotal role in transforming the healthcare regulatory-affairs-outsourcing market in South America. The adoption of digital tools and platforms for regulatory submissions is streamlining processes, reducing timeframes, and enhancing accuracy. For instance, electronic submission systems are becoming increasingly prevalent, allowing companies to submit regulatory documents more efficiently. This shift towards digitalization is likely to attract more firms to outsource their regulatory affairs, as they seek to leverage technology for improved compliance and faster market access. The healthcare regulatory-affairs-outsourcing market is projected to grow as organizations recognize the benefits of integrating technology into their regulatory processes, potentially leading to a market growth rate of 15% over the next few years.

Expansion of Pharmaceutical and Biotechnology Sectors

The expansion of the pharmaceutical and biotechnology sectors in South America is significantly influencing the healthcare regulatory-affairs-outsourcing market. Countries like Brazil and Chile are witnessing a surge in the establishment of biotech firms, which require robust regulatory support to bring innovative products to market. The region's pharmaceutical market is expected to reach approximately $40 billion by 2026, creating a substantial opportunity for outsourcing regulatory affairs. As these sectors grow, the demand for regulatory expertise to navigate the approval processes for new drugs and therapies is likely to increase, thereby driving the healthcare regulatory-affairs-outsourcing market. This expansion not only enhances the need for regulatory services but also fosters collaboration between local firms and international regulatory consultants.