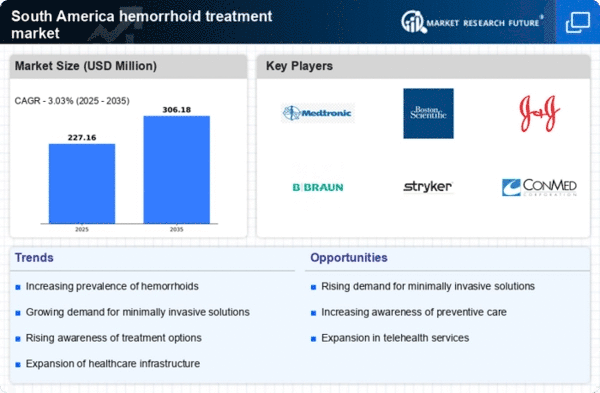

Rising Healthcare Expenditure

The increase in healthcare expenditure across South America is a significant driver for the hemorrhoid treatment-devices market. As governments and private sectors allocate more funds towards healthcare, there is a corresponding rise in the availability of advanced medical devices. In 2025, healthcare spending in the region is expected to reach approximately $500 billion, facilitating better access to treatment options for patients suffering from hemorrhoids. This financial commitment allows for the procurement of innovative devices and technologies, thereby enhancing treatment efficacy. Furthermore, as patients become more aware of available treatments, the demand for effective hemorrhoid treatment-devices is likely to grow, further stimulating market expansion.

Increasing Incidence of Hemorrhoids

The rising incidence of hemorrhoids in South America is a crucial driver for the hemorrhoid treatment-devices market. Factors such as dietary habits, sedentary lifestyles, and an aging population contribute to this trend. Recent studies indicate that approximately 50% of adults will experience hemorrhoids at some point in their lives. This growing prevalence necessitates effective treatment options, thereby boosting demand for various devices. As healthcare providers seek to address this issue, the market for hemorrhoid treatment-devices is projected to expand significantly.. The increasing burden on healthcare systems to manage this condition further emphasizes the need for innovative solutions, which may lead to a surge in product development and availability in the region.

Growing Focus on Preventive Healthcare

The growing focus on preventive healthcare in South America is influencing the hemorrhoid treatment-devices market. As awareness of health issues increases, individuals are more inclined to seek preventive measures to avoid conditions such as hemorrhoids. This trend is reflected in the rising demand for devices that not only treat but also prevent the recurrence of hemorrhoids. Educational campaigns and community health initiatives are promoting lifestyle changes that can mitigate risk factors associated with hemorrhoids. Consequently, manufacturers are likely to develop devices that cater to this preventive approach, thereby expanding their market reach and enhancing overall patient outcomes.

Technological Integration in Healthcare

The integration of technology in healthcare is transforming the hemorrhoid treatment-devices market. Innovations such as telemedicine and digital health platforms are facilitating better patient management and follow-up care. This technological advancement allows for more efficient monitoring of treatment outcomes and patient satisfaction. In South America, the adoption of these technologies is expected to enhance the accessibility and effectiveness of hemorrhoid treatments. As healthcare providers increasingly utilize technology to streamline operations, the demand for advanced treatment devices is likely to rise. This trend not only improves patient engagement but also encourages the development of new devices tailored to meet the evolving needs of the market.

Shift Towards Minimally Invasive Procedures

There is a notable shift towards minimally invasive procedures in the treatment of hemorrhoids, which is driving the hemorrhoid treatment-devices market. Patients increasingly prefer treatments that offer quicker recovery times and reduced discomfort. Devices such as rubber band ligators and infrared coagulation units are gaining traction due to their effectiveness and lower complication rates. The market for these devices is projected to grow as more healthcare facilities adopt these techniques. In South America, the demand for such minimally invasive options is likely to increase, reflecting a broader trend in surgical practices. This shift not only enhances patient satisfaction but also encourages healthcare providers to invest in advanced treatment technologies.

Leave a Comment