Increasing Health Consciousness

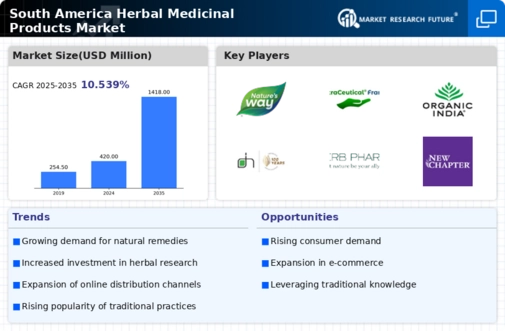

The growing awareness of health and wellness among consumers in South America appears to be a significant driver for the herbal medicinal-products market. As individuals become more informed about the benefits of natural remedies, there is a noticeable shift towards herbal alternatives. This trend is reflected in market data, indicating that the herbal medicinal-products market in South America is projected to grow at a CAGR of approximately 8% from 2025 to 2030. Consumers are increasingly seeking products that align with their health goals, leading to a surge in demand for herbal supplements and remedies. This heightened health consciousness is likely to continue influencing purchasing decisions, as more individuals prioritize natural solutions over synthetic pharmaceuticals.

Regulatory Support for Herbal Products

Regulatory frameworks in South America are evolving to support the herbal medicinal-products market. Governments are recognizing the potential of herbal remedies and are implementing policies that facilitate their development and distribution. For instance, certain countries have established guidelines for the registration and quality control of herbal products, which enhances consumer trust. This regulatory support is crucial, as it not only legitimizes the industry but also encourages investment in research and development. As a result, the herbal medicinal-products market is expected to benefit from increased innovation and a broader range of offerings, potentially leading to a market value exceeding $5 billion by 2030.

Rising Popularity of Preventive Healthcare

The shift towards preventive healthcare in South America is emerging as a key driver for the herbal medicinal-products market. Consumers are increasingly adopting proactive health measures, seeking products that can enhance their well-being and prevent illness. This trend is evident in the growing sales of herbal supplements, which are perceived as effective tools for maintaining health. Market analysis suggests that the herbal medicinal-products market could see a growth rate of around 7% annually as more individuals incorporate herbal solutions into their daily routines. This focus on prevention rather than treatment aligns with the broader global movement towards holistic health, further solidifying the position of herbal products in the market.

Cultural Heritage and Traditional Knowledge

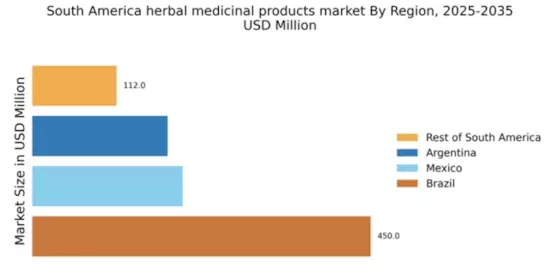

Cultural heritage plays a pivotal role in shaping the herbal medicinal-products market in South America. Many communities possess extensive traditional knowledge regarding the use of local herbs for medicinal purposes. This rich cultural background not only fosters a strong demand for herbal products but also encourages the preservation of indigenous practices. As consumers increasingly value authenticity and heritage, products that highlight traditional formulations are gaining traction. The herbal medicinal-products market is likely to benefit from this cultural integration, as it appeals to both local consumers and international markets seeking unique, authentic offerings. This trend may lead to a diversification of products, enhancing market growth.

E-commerce Growth and Digital Accessibility

The rise of e-commerce platforms in South America is transforming the way consumers access herbal medicinal products. With increasing internet penetration and smartphone usage, consumers are now able to purchase herbal remedies online with ease. This shift is particularly beneficial for small and medium-sized enterprises that may not have the resources for traditional retail distribution. Market data indicates that online sales of herbal products are expected to grow by over 15% annually, reflecting a significant change in consumer behavior. The convenience of online shopping, coupled with the ability to access a wider range of products, is likely to drive the herbal medicinal-products market forward, making it more accessible to a broader audience.