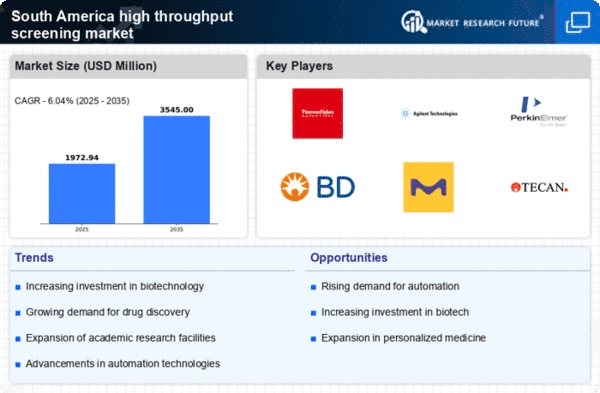

Investment in Biotechnology

Investment in biotechnology is significantly influencing the high throughput-screening market in South America. With governments and private entities increasing funding for biotech research, there is a notable expansion in laboratories and research facilities equipped with advanced screening technologies. In 2025, it is estimated that biotechnology investments in the region will exceed $500 million, fostering innovation and collaboration among research institutions. This influx of capital is likely to enhance the capabilities of the high throughput-screening market, allowing for more comprehensive screening processes and the development of novel therapeutics. The synergy between biotechnology and high throughput screening is expected to yield substantial advancements in drug discovery.

Rising Demand for Drug Discovery

The high throughput-screening market in South America is experiencing a surge in demand driven by the increasing need for efficient drug discovery processes. Pharmaceutical companies are focusing on reducing the time and cost associated with drug development, which has led to a greater reliance on high throughput screening technologies. In 2025, the market is projected to reach approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 10%. This growth is largely attributed to the rising prevalence of chronic diseases and the need for innovative therapeutic solutions. As a result, the high throughput-screening market is becoming a critical component in the pharmaceutical landscape, enabling faster identification of potential drug candidates.

Growing Focus on Personalized Medicine

The high throughput-screening market in South America is being propelled by the growing focus on personalized medicine. As healthcare shifts towards more individualized treatment approaches, the demand for screening technologies that can identify specific biomarkers is increasing. This trend is expected to drive the market's growth, with projections indicating a potential market size of $1.2 billion by 2025. The high throughput-screening market plays a pivotal role in enabling the identification of patient-specific drug responses, thereby enhancing treatment efficacy. The integration of high throughput screening with genomic and proteomic data is likely to further refine therapeutic strategies, making personalized medicine a key driver in the region.

Emergence of Startups and Innovation Hubs

The emergence of startups and innovation hubs in South America is significantly impacting the high throughput-screening market. These entities are fostering a culture of innovation, leading to the development of novel screening technologies and methodologies. In 2025, it is anticipated that the number of biotech startups focusing on high throughput screening will increase by 25%, contributing to a more dynamic market landscape. The high throughput-screening market is benefiting from this influx of creativity, as startups often bring fresh perspectives and agile approaches to research and development. This trend is likely to enhance competition and drive advancements in screening technologies, ultimately benefiting the broader healthcare ecosystem.

Increased Collaboration Between Academia and Industry

Increased collaboration between academia and industry is emerging as a vital driver for the high throughput-screening market in South America. Partnerships between universities and pharmaceutical companies are facilitating the exchange of knowledge and resources, leading to more effective screening processes. In 2025, it is projected that collaborative research initiatives will account for approximately 30% of the market's growth. The high throughput-screening market is benefiting from these collaborations, as they often result in the development of cutting-edge technologies and methodologies. This synergy not only accelerates the pace of research but also enhances the overall quality of drug discovery efforts in the region.