Rising Healthcare Expenditure

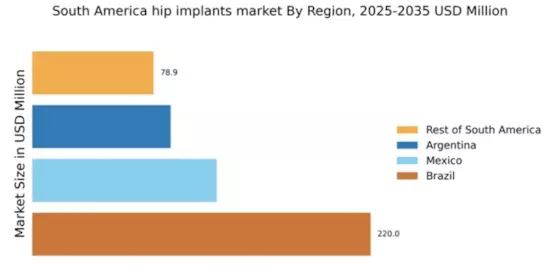

In South America, rising healthcare expenditure is influencing the hip implants market. Governments and private sectors are increasingly investing in healthcare infrastructure, which includes orthopedic services. For instance, countries like Brazil and Argentina have seen healthcare spending rise by over 5% annually in recent years. This increase in funding allows for better access to advanced medical technologies, including hip implants. As healthcare facilities upgrade their offerings, the availability of high-quality implants is likely to improve, thereby driving market growth. Enhanced healthcare spending also correlates with improved patient outcomes, further encouraging the adoption of hip implants.

Increasing Awareness of Joint Health

There is a growing awareness of joint health among the South American population, which is positively impacting the hip implants market. Educational campaigns and health initiatives are encouraging individuals to seek medical advice for joint-related issues earlier. This proactive approach is likely to lead to an increase in diagnoses of hip disorders, subsequently driving demand for surgical interventions and hip implants. Furthermore, as more people become informed about the benefits of timely treatment, the market may experience a surge in patients opting for hip replacement surgeries, thereby enhancing overall market growth.

Improved Access to Orthopedic Services

Improved access to orthopedic services is a crucial driver for the hip implants market in South America. The expansion of healthcare facilities and the establishment of specialized orthopedic clinics are making it easier for patients to receive timely care. In urban areas, the availability of advanced surgical options is increasing, while rural regions are also seeing enhancements in healthcare access. This trend is likely to facilitate earlier interventions for hip disorders, leading to a higher uptake of hip implants. As healthcare systems continue to evolve, the overall accessibility of orthopedic services is expected to bolster the market, ensuring that more patients can benefit from hip replacement surgeries.

Technological Advancements in Implant Design

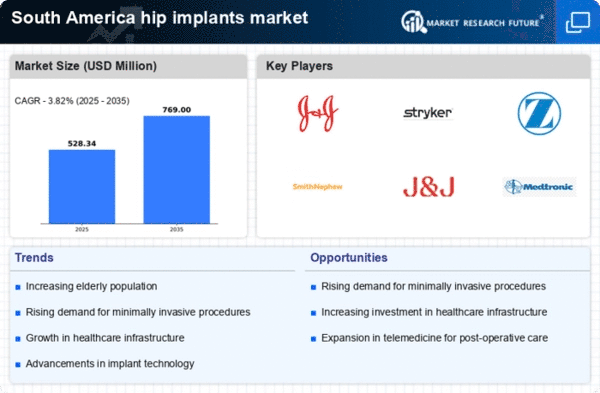

Technological advancements in implant design are reshaping the hip implants market in South America. Innovations such as 3D printing and the development of biocompatible materials are enhancing the performance and longevity of hip implants. These advancements not only improve surgical outcomes but also reduce the risk of complications, which is crucial for patient satisfaction. The market for hip implants is projected to grow at a CAGR of around 6% over the next five years, driven by these technological improvements. As manufacturers continue to invest in research and development, the availability of cutting-edge implants is likely to expand, catering to the diverse needs of patients.

Aging Population and Increased Incidence of Hip Disorders

The aging population in South America is a primary driver for the hip implants market. As individuals age, the prevalence of hip disorders, such as osteoarthritis and fractures, tends to increase. This demographic shift is projected to lead to a higher demand for hip implants, as older adults often require surgical interventions to maintain mobility and quality of life. According to recent estimates, the population aged 65 and older in South America is expected to reach approximately 10% by 2030. This growing segment is likely to contribute significantly to the hip implants market, as healthcare systems adapt to meet the needs of an aging populace.