Aging Population

The demographic shift towards an aging population in South America is a crucial factor driving the home infusion-therapy-devices market. As individuals age, they often experience multiple health issues that require ongoing treatment, including the need for infusion therapies. Projections suggest that by 2030, the elderly population in South America will increase by over 20%, leading to a higher demand for home healthcare solutions. This trend indicates a growing market for home infusion-therapy-devices, as older adults prefer receiving care in the comfort of their homes. The home infusion-therapy-devices market must adapt to this demographic change by developing user-friendly devices tailored to the needs of elderly patients.

Cost-Effectiveness of Home Care

The economic advantages associated with home care are increasingly influencing the home infusion-therapy-devices market in South America. Home infusion therapy can significantly reduce healthcare costs by minimizing hospital stays and associated expenses. Studies indicate that home-based care can save healthcare systems up to 30% compared to traditional inpatient care. As healthcare providers and patients alike recognize these financial benefits, the demand for home infusion-therapy-devices is expected to rise. This shift towards cost-effective treatment options is likely to drive investments in the home infusion-therapy-devices market, fostering the development of more affordable and accessible devices for patients.

Increased Awareness and Education

Growing awareness and education regarding home healthcare options are pivotal in shaping the home infusion-therapy-devices market in South America. As patients and caregivers become more informed about the benefits of home infusion therapy, the demand for related devices is likely to rise. Educational initiatives by healthcare organizations and government bodies are crucial in promoting the advantages of home-based care, including improved quality of life and reduced hospital visits. This heightened awareness is expected to stimulate interest in the home infusion-therapy-devices market, leading to increased adoption of these therapies among patients who require long-term treatment.

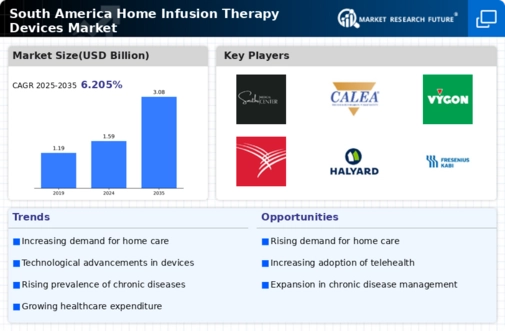

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in South America is a primary driver for the home infusion-therapy-devices market. Conditions such as diabetes, cancer, and cardiovascular diseases necessitate ongoing treatment, often requiring infusion therapies. According to health statistics, chronic diseases account for approximately 60% of all deaths in the region, highlighting the urgent need for effective home care solutions. This trend is likely to propel the demand for home infusion-therapy-devices, as patients seek convenient and effective management of their conditions at home. The home infusion-therapy-devices market is thus positioned to grow as healthcare systems adapt to meet the needs of this patient demographic, potentially leading to innovations in device technology and service delivery.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the home infusion-therapy-devices market in South America. Innovations such as telehealth, remote monitoring, and smart infusion pumps are enhancing patient care and safety. These technologies allow healthcare providers to monitor patients' conditions in real-time, ensuring timely interventions when necessary. The home infusion-therapy-devices market is likely to benefit from these advancements, as they improve the overall efficiency and effectiveness of home infusion therapies. Furthermore, the adoption of digital health solutions is expected to increase patient engagement and adherence to treatment protocols, thereby driving market growth.