Aging Population Demographics

The demographic shift towards an aging population in South America is influencing the hospital furniture market. As the population ages, there is a growing need for healthcare services, which in turn drives the demand for specialized hospital furniture. For example, the proportion of individuals aged 65 and older is expected to rise to 15% by 2030 in countries like Argentina and Chile. This demographic trend necessitates the development of furniture that caters to the specific needs of elderly patients, such as adjustable beds and supportive seating. Consequently, the hospital furniture market is poised for expansion as healthcare providers seek to enhance their facilities to accommodate this demographic shift.

Increasing Healthcare Expenditure

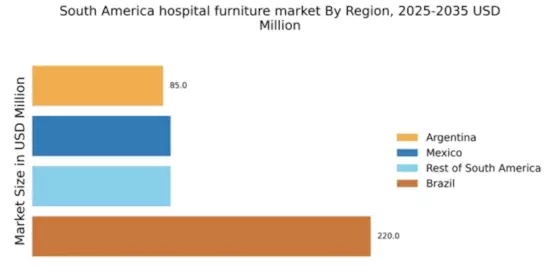

The rising healthcare expenditure in South America is a pivotal driver for the hospital furniture market. Governments and private entities are allocating more funds towards healthcare infrastructure, which includes the procurement of hospital furniture. For instance, Brazil's healthcare spending is projected to reach approximately $200 billion by 2025, indicating a robust investment in healthcare facilities. This increase in budget allows hospitals to upgrade their furniture, ensuring that they meet modern standards of comfort and functionality. As a result, the hospital furniture market is likely to experience significant growth, driven by the demand for high-quality, durable, and aesthetically pleasing furniture that enhances patient care and staff efficiency.

Government Regulations and Standards

Government regulations and standards regarding healthcare facilities are significantly impacting the hospital furniture market. In South America, regulatory bodies are establishing guidelines that dictate the quality and safety of hospital furniture. Compliance with these regulations is essential for healthcare providers, prompting them to invest in high-quality, certified furniture. For instance, regulations may require that hospital beds meet specific safety standards to prevent patient injuries. As a result, the hospital furniture market is likely to see increased demand for products that adhere to these stringent regulations, ensuring that healthcare facilities provide safe and effective environments for patient care.

Rising Demand for Patient-Centric Care

The shift towards patient-centric care in South America is reshaping the hospital furniture market. Healthcare providers are increasingly recognizing the importance of creating environments that promote healing and comfort for patients. This trend is reflected in the design and functionality of hospital furniture, which is being tailored to enhance the patient experience. For instance, hospitals are investing in furniture that allows for better mobility and accessibility, such as height-adjustable beds and modular seating. The hospital furniture market is likely to benefit from this trend, as facilities strive to create welcoming and supportive environments that prioritize patient well-being.

Technological Advancements in Furniture Design

Technological advancements are playing a crucial role in the evolution of the hospital furniture market. Innovations such as smart beds and integrated monitoring systems are becoming increasingly prevalent in South American hospitals. These technologies not only improve patient care but also streamline hospital operations. For example, smart beds equipped with sensors can monitor patient vitals and adjust positions automatically, enhancing comfort and safety. As hospitals adopt these advanced solutions, the hospital furniture market is expected to grow, driven by the demand for furniture that integrates seamlessly with modern healthcare technologies.