Rising Geriatric Population

The demographic shift towards an aging population in South America is expected to drive the intravenous solution market. By 2030, it is projected that the number of individuals aged 65 and older will increase significantly, leading to a higher demand for medical care, including intravenous therapies. Older adults often require more complex medical treatments, which frequently involve intravenous solutions for hydration, nutrition, and medication administration. The intravenous solution market must adapt to this demographic trend by ensuring the availability of specialized products tailored to the needs of the elderly, thereby enhancing patient care and treatment efficacy.

Increasing Healthcare Expenditure

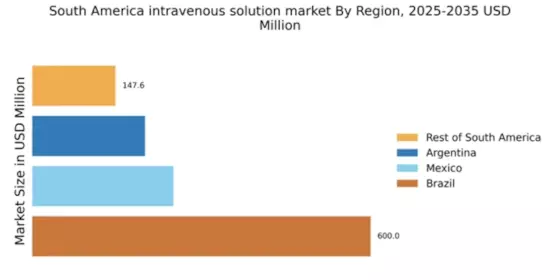

The intravenous solution market in South America is likely to benefit from the rising healthcare expenditure across various countries in the region. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of intravenous solutions. For instance, Brazil's healthcare spending has seen an increase of approximately 10% in recent years, indicating a growing commitment to improving healthcare services. This trend suggests that as healthcare budgets expand, the demand for intravenous solutions will also rise, driven by the need for effective patient management and treatment options. The intravenous solution market is poised to capitalize on this increased funding, potentially leading to enhanced product availability and innovation.

Expansion of Healthcare Facilities

The intravenous solution market in South America is likely to experience growth due to the expansion of healthcare facilities, including hospitals and clinics. Many countries in the region are investing in new healthcare infrastructure to improve access to medical services. For example, Colombia has seen a surge in the establishment of private hospitals, which often prioritize advanced medical technologies and treatment options. This expansion creates a favorable environment for the intravenous solution market, as more healthcare facilities will require a steady supply of intravenous solutions to meet the needs of their patients, ultimately driving market growth.

Increased Awareness of Patient Care

There is a growing awareness of the importance of patient care and treatment efficacy in South America, which is positively impacting the intravenous solution market. Healthcare professionals and institutions are increasingly recognizing the role of intravenous solutions in enhancing patient outcomes, particularly in critical care settings. This heightened awareness is likely to lead to more rigorous training for healthcare providers on the use of intravenous therapies, thereby increasing the demand for high-quality intravenous solutions. The intravenous solution market stands to benefit from this trend, as healthcare providers seek to implement best practices in patient care and treatment protocols.

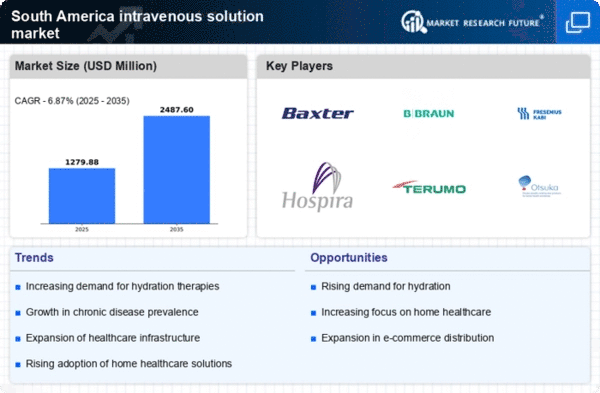

Growing Prevalence of Chronic Diseases

The intravenous solution market in South America is significantly influenced by the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer. According to recent health statistics, chronic diseases account for nearly 70% of all deaths in the region, necessitating effective treatment options. This situation creates a robust demand for intravenous solutions, which are essential for administering medications and fluids to patients with chronic conditions. The intravenous solution market is likely to expand as healthcare providers seek to improve patient outcomes through timely and effective intravenous therapies, thereby addressing the growing burden of chronic diseases.