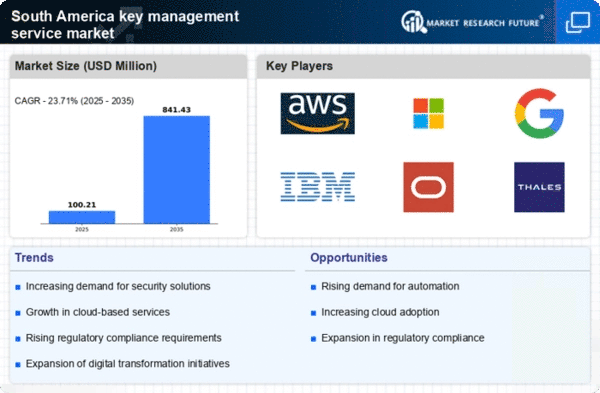

Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in South America is creating new challenges and opportunities for the key management-service market. With the increasing number of connected devices, the need for secure key management solutions to protect data transmitted between these devices is becoming more pronounced. By 2025, it is anticipated that the number of IoT devices in the region will surpass 1 billion, leading to a potential increase in demand for key management services. This growth indicates that organizations must prioritize security measures to mitigate risks associated with IoT deployments.

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks in South America is driving demand for robust key management services. Organizations are recognizing the necessity of safeguarding sensitive data, which has led to a heightened focus on encryption and key management solutions. In 2025, it is estimated that cybersecurity spending in the region will reach approximately $20 billion, reflecting a growth of around 15% from previous years. This trend indicates a strong correlation between the rise in cybersecurity threats and the expansion of the key management-service market, as businesses seek to protect their assets and maintain customer trust.

Regulatory Compliance Requirements

The evolving regulatory landscape in South America is compelling organizations to adopt stringent data protection measures. Compliance with laws such as the General Data Protection Regulation (GDPR) and local data protection regulations necessitates effective key management solutions. Companies are increasingly investing in these services to ensure adherence to legal requirements, thereby avoiding hefty fines and reputational damage. The key management-service market is likely to see a surge in demand as organizations prioritize compliance, with estimates suggesting that compliance-related spending could account for up to 30% of total IT budgets in the region by 2026.

Growth of Digital Transformation Initiatives

As businesses in South America undergo digital transformation, the need for secure data management becomes paramount. The shift towards digital platforms and services is driving the adoption of key management solutions to protect sensitive information. In 2025, the digital transformation market in South America is projected to grow by 25%, which will likely enhance the key management-service market as organizations seek to integrate security measures into their digital strategies. This growth indicates a strong interdependence between digital transformation efforts and the demand for effective key management services.

Increased Investment in Cloud Infrastructure

The rapid adoption of cloud computing in South America is significantly influencing the key management-service market. As organizations migrate to cloud environments, the need for secure key management solutions becomes critical to protect data stored in the cloud. In 2025, cloud services spending in the region is expected to exceed $10 billion, with a growth rate of approximately 20%. This trend suggests that as more businesses leverage cloud technologies, the demand for key management services will likely rise, emphasizing the importance of securing cloud-based data.