Expansion of Educational Institutions

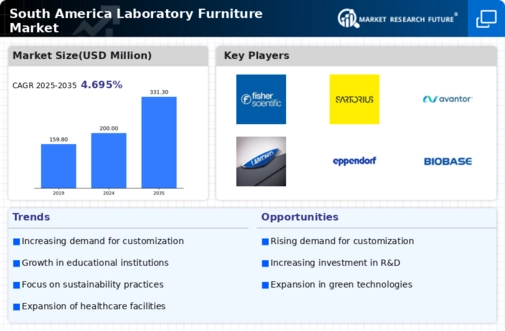

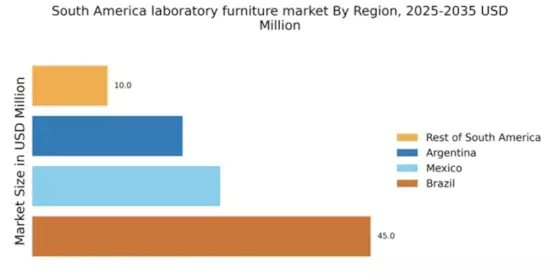

The expansion of educational institutions across South America significantly impacts the laboratory furniture market. With an increasing number of universities and technical colleges being established, there is a heightened need for well-equipped laboratories. For example, Argentina has reported a 20% increase in the number of higher education institutions in recent years, which correlates with a growing demand for laboratory furniture. These institutions require a variety of furniture solutions, including workbenches, storage units, and safety equipment, to facilitate effective learning and research. As educational programs evolve to include more hands-on scientific training, the laboratory furniture market is poised to benefit from this trend. The need for modern, flexible, and safe laboratory environments is likely to drive sales, as educational institutions seek to provide students with the best possible resources for their studies.

Rising Investment in Research and Development

The laboratory furniture market in South America is experiencing a notable surge in investment directed towards research and development (R&D). Governments and private entities are increasingly allocating funds to enhance scientific capabilities, which in turn drives demand for specialized laboratory furniture. For instance, Brazil has seen a 15% increase in R&D spending over the past year, reflecting a growing commitment to innovation. This trend is likely to bolster the laboratory furniture market, as modern laboratories require advanced furniture solutions that support various research activities. Furthermore, the emphasis on creating state-of-the-art research facilities necessitates the procurement of high-quality laboratory furniture, thereby stimulating market growth. As institutions strive to meet international standards, the demand for ergonomic, durable, and adaptable laboratory furniture is expected to rise, indicating a robust future for the industry in the region.

Technological Advancements in Laboratory Design

Technological advancements in laboratory design are reshaping the laboratory furniture market in South America. Innovations in materials and design techniques are leading to the development of more efficient and functional laboratory environments. For example, the use of modular furniture systems allows for greater flexibility in laboratory layouts, accommodating various research needs. As laboratories adopt new technologies, such as automation and digital monitoring systems, the demand for compatible furniture solutions is likely to increase. This trend suggests that manufacturers must stay abreast of technological developments to provide furniture that meets the evolving needs of modern laboratories. The integration of smart technologies into laboratory furniture could further enhance productivity and safety, indicating a promising future for the industry as it adapts to these changes.

Growing Pharmaceutical and Biotechnology Sectors

The growth of the pharmaceutical and biotechnology sectors in South America is a significant driver for the laboratory furniture market. As these industries expand, there is an increasing need for advanced laboratory facilities equipped with specialized furniture. Countries like Brazil and Colombia are witnessing a rise in pharmaceutical production, with investments reaching approximately $1 billion in recent years. This growth necessitates the procurement of high-quality laboratory furniture that can support complex research and development activities. The demand for laboratory furniture that meets the specific requirements of these sectors, such as chemical resistance and modularity, is likely to increase. Consequently, the laboratory furniture market is expected to thrive as companies seek to create efficient and compliant laboratory environments to foster innovation and product development.

Increased Focus on Health and Safety Regulations

The laboratory furniture market in South America is influenced by an increased focus on health and safety regulations. Governments are implementing stricter guidelines to ensure safe working environments in laboratories, which necessitates the use of compliant furniture solutions. For instance, the introduction of new safety standards in Chile has prompted laboratories to upgrade their furniture to meet these regulations. This shift is likely to create a demand for specialized laboratory furniture that adheres to safety protocols, such as chemical-resistant surfaces and ergonomic designs. As organizations prioritize employee safety and regulatory compliance, the laboratory furniture market is expected to grow. The potential for increased sales of safety-compliant furniture solutions indicates a positive outlook for the industry, as laboratories invest in equipment that not only meets legal requirements but also enhances operational efficiency.