Rising Environmental Concerns

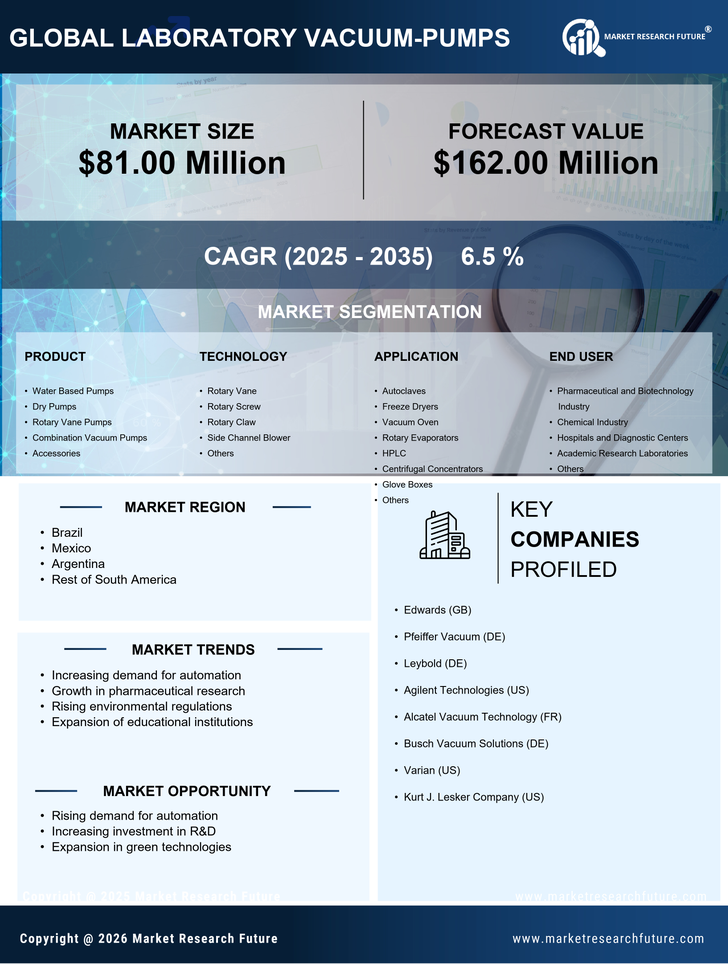

Environmental sustainability is becoming a critical focus in South America, influencing various industries, including the laboratory vacuum-pumps market. As regulations tighten around emissions and waste management, laboratories are increasingly adopting vacuum systems that minimize environmental impact. The laboratory vacuum-pumps market is responding to this trend by developing eco-friendly models that utilize less energy and produce fewer emissions. This shift not only aligns with regulatory requirements but also appeals to environmentally conscious consumers. The market for sustainable laboratory equipment is expected to grow by approximately 15% annually, indicating a strong potential for vacuum pump manufacturers to innovate and capture this emerging segment.

Expansion of Research Institutions

The proliferation of research institutions across South America is driving the laboratory vacuum-pumps market. With an increasing number of universities and private research facilities being established, the demand for laboratory equipment, including vacuum pumps, is on the rise. In 2025, it is estimated that the number of research institutions in South America will increase by 20%, leading to a heightened need for advanced laboratory technologies. These institutions require reliable vacuum systems for various applications, such as material science and biotechnology research. As a result, manufacturers in the laboratory vacuum-pumps market are likely to see increased orders and opportunities for collaboration with these institutions.

Increased Focus on Quality Control

Quality control is becoming increasingly vital in various sectors, including food and beverage, chemicals, and pharmaceuticals, thereby influencing the laboratory vacuum-pumps market. As companies strive to meet stringent quality standards, the demand for reliable laboratory equipment, including vacuum pumps, is expected to rise. In South America, the food and beverage sector alone is projected to grow by 10% in 2025, necessitating enhanced quality control measures. This trend is likely to drive investments in laboratory technologies that ensure product safety and compliance with regulations. Consequently, the laboratory vacuum-pumps market stands to benefit from this heightened focus on quality assurance, as businesses seek to implement robust testing and analysis processes.

Growing Demand in Pharmaceutical Sector

The pharmaceutical sector in South America is experiencing a notable expansion, which appears to be a significant driver for the laboratory vacuum-pumps market. As pharmaceutical companies increasingly focus on research and development, the need for efficient vacuum systems becomes paramount. In 2025, the pharmaceutical industry in South America is projected to reach a market value of approximately $50 billion, indicating a robust growth trajectory. This growth necessitates advanced laboratory equipment, including vacuum pumps, to ensure optimal conditions for drug formulation and testing. Consequently, the laboratory vacuum-pumps market is likely to benefit from this rising demand, as companies seek reliable and efficient solutions to enhance their production processes.

Technological Integration in Laboratories

The integration of advanced technologies in laboratory settings is significantly impacting the laboratory vacuum-pumps market in South America. Automation and digitalization are becoming prevalent, with laboratories seeking to enhance efficiency and accuracy in their operations. Vacuum pumps equipped with smart technology, such as IoT connectivity and real-time monitoring, are gaining traction. This trend is expected to drive the market growth, as laboratories aim to streamline processes and reduce human error. The laboratory vacuum-pumps market could see a growth rate of around 12% as more facilities adopt these innovative solutions, reflecting a shift towards modernized laboratory environments.