Rising Demand for Quality Control

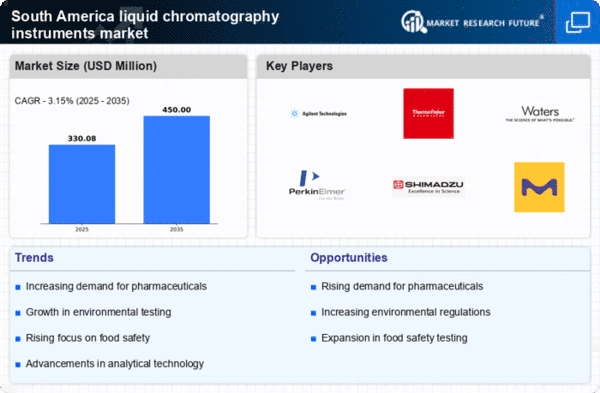

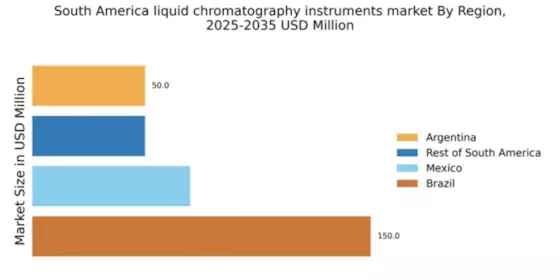

The increasing emphasis on quality control in various industries, particularly pharmaceuticals and food and beverage, drives the liquid chromatography-instruments market in South America. Companies are investing in advanced analytical techniques to ensure product safety and compliance with stringent regulations. The market for liquid chromatography instruments is projected to grow at a CAGR of approximately 6.5% from 2025 to 2030, reflecting the rising need for reliable testing methods. As industries strive to meet consumer expectations and regulatory standards, the demand for sophisticated liquid chromatography instruments is likely to surge. This trend is particularly evident in Brazil and Argentina, where regulatory bodies are enforcing stricter quality assurance measures. Consequently, manufacturers are compelled to adopt advanced liquid chromatography technologies to maintain competitiveness and ensure compliance.

Expansion of Pharmaceutical Sector

The pharmaceutical sector in South America is experiencing robust growth, which significantly impacts the liquid chromatography-instruments market. With an increasing number of drug development projects and clinical trials, there is a heightened need for precise analytical instruments. The market is expected to witness a growth rate of around 7% annually, driven by the rising investments in research and development. Countries like Brazil and Chile are becoming hubs for pharmaceutical innovation, necessitating the use of advanced liquid chromatography techniques for drug formulation and quality testing. This expansion not only enhances the demand for liquid chromatography instruments but also encourages local manufacturers to innovate and improve their offerings. As the pharmaceutical landscape evolves, the reliance on liquid chromatography for analytical purposes is likely to intensify.

Increased Focus on Environmental Testing

Environmental concerns are becoming increasingly prominent in South America, leading to a growing demand for liquid chromatography instruments for environmental testing. Governments and organizations are prioritizing the monitoring of pollutants and contaminants in water, soil, and air. This trend is likely to propel the liquid chromatography-instruments market, as these instruments are essential for accurate analysis and compliance with environmental regulations. The market is projected to grow by approximately 5% annually, reflecting the rising investments in environmental protection initiatives. Countries such as Colombia and Peru are implementing stricter environmental policies, which necessitate the use of advanced analytical techniques. As a result, the demand for liquid chromatography instruments is expected to rise, driven by the need for effective environmental monitoring and assessment.

Technological Integration in Laboratories

The integration of advanced technologies in laboratory settings is transforming the liquid chromatography-instruments market in South America. Automation and data management systems are increasingly being adopted to enhance efficiency and accuracy in analytical processes. This trend is likely to drive market growth, as laboratories seek to optimize their operations and reduce human error. The liquid chromatography-instruments market is anticipated to grow at a rate of around 6% per year, fueled by the demand for integrated solutions that streamline workflows. Countries like Argentina and Brazil are witnessing a shift towards automated systems, which not only improve productivity but also facilitate compliance with regulatory standards. As laboratories continue to embrace technological advancements, the demand for sophisticated liquid chromatography instruments is expected to rise.

Growing Academic and Research Institutions

The proliferation of academic and research institutions in South America is contributing to the growth of the liquid chromatography-instruments market. These institutions are increasingly engaging in research activities that require advanced analytical techniques, thereby driving demand for liquid chromatography instruments. The market is projected to expand at a CAGR of approximately 5.5% as educational and research facilities invest in state-of-the-art equipment. Countries such as Brazil and Chile are enhancing their research capabilities, which necessitates the use of liquid chromatography for various applications, including biochemistry and environmental science. This trend not only boosts the demand for liquid chromatography instruments but also encourages collaboration between academia and industry, fostering innovation and development in analytical technologies.