Expansion of Smart City Initiatives

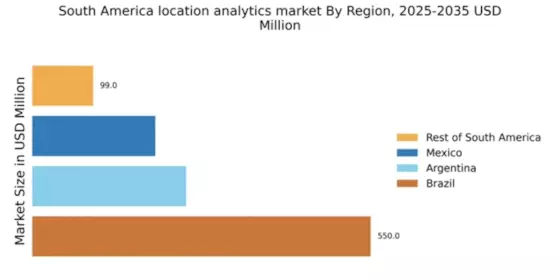

The proliferation of smart city initiatives across South America significantly influences the location analytics market. Governments and municipalities are increasingly investing in technology to enhance urban infrastructure, improve public services, and promote sustainable development. These initiatives often incorporate location analytics to monitor traffic patterns, manage public transportation, and optimize energy consumption. For instance, cities like Sao Paulo and Buenos Aires are implementing smart solutions that leverage location data to address urban challenges. The investment in smart city projects is expected to reach approximately $50 billion by 2027, creating substantial opportunities for location analytics providers to contribute to urban planning and management.

Rising Demand for Real-Time Data Analysis

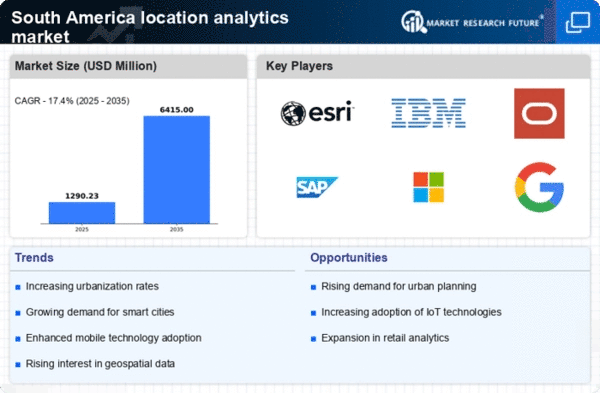

The location analytics market in South America experiences a notable surge in demand for real-time data analysis. Businesses across various sectors, including retail and logistics, increasingly rely on timely insights to enhance operational efficiency and customer engagement. The ability to analyze location-based data in real-time allows organizations to make informed decisions, optimize resource allocation, and improve service delivery. According to recent estimates, the market for real-time analytics in South America is projected to grow at a CAGR of approximately 15% over the next five years. This trend indicates a robust appetite for solutions that facilitate immediate data processing and visualization, thereby driving the growth of the location analytics market.

Growth of E-Commerce and Delivery Services

The rapid expansion of e-commerce and delivery services in South America is a key driver for the location analytics market. As online shopping becomes increasingly popular, businesses are seeking ways to optimize their logistics and supply chain operations. Location analytics plays a crucial role in route optimization, inventory management, and customer targeting. Recent data indicates that e-commerce sales in South America are projected to exceed $100 billion by 2025, highlighting the need for effective location-based strategies. Companies are leveraging analytics to enhance delivery efficiency, reduce costs, and improve customer satisfaction, thereby propelling the growth of the location analytics market.

Emergence of Location-Based Marketing Strategies

The emergence of location-based marketing strategies is reshaping the landscape of the location analytics market in South America. Businesses are increasingly utilizing location data to tailor marketing campaigns and enhance customer engagement. By analyzing consumer behavior and preferences based on geographic location, companies can deliver personalized offers and promotions. This approach not only improves customer satisfaction but also drives sales growth. Recent studies suggest that location-based marketing can increase conversion rates by up to 30%. As businesses continue to adopt these strategies, the demand for location analytics solutions is likely to rise, further fueling market growth.

Increased Investment in Geographic Information Systems (GIS)

The location analytics market in South America is witnessing a significant increase in investment in Geographic Information Systems (GIS). Organizations are recognizing the value of spatial data in decision-making processes, leading to enhanced planning and operational strategies. GIS technology enables businesses to visualize and analyze geographic data, facilitating better insights into market trends and consumer behavior. The South American GIS market is expected to grow at a CAGR of around 12% over the next few years, driven by the demand for advanced mapping solutions and location intelligence. This investment trend underscores the importance of GIS in the broader context of location analytics.