Increasing Research Activities

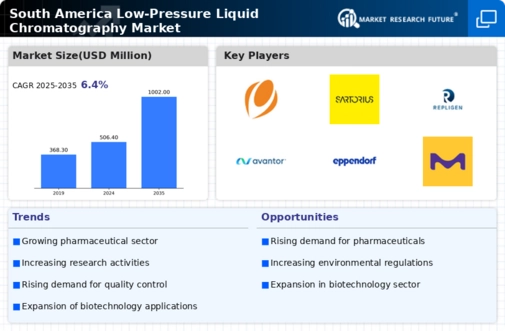

The low pressure-liquid-chromatography market in South America is experiencing a surge in research activities across various sectors, particularly in pharmaceuticals and biotechnology. This trend is driven by the need for advanced analytical techniques to ensure product quality and compliance with regulatory standards. As research institutions and universities enhance their capabilities, the demand for low pressure-liquid-chromatography systems is likely to rise. In 2025, the market is projected to grow at a CAGR of approximately 6.5%, reflecting the increasing investment in R&D. Furthermore, collaborations between academic institutions and industry players are fostering innovation, thereby propelling the low pressure-liquid-chromatography market forward.

Growing Biopharmaceutical Sector

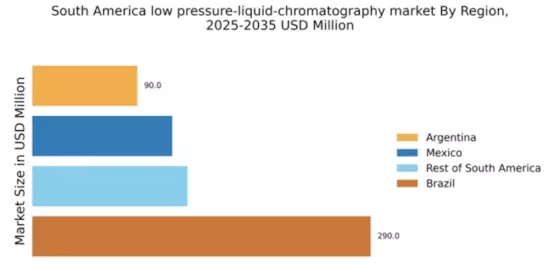

The biopharmaceutical sector in South America is expanding rapidly, which is significantly impacting the low pressure-liquid-chromatography market. With an increasing number of biopharmaceutical companies emerging in countries like Brazil and Argentina, there is a heightened demand for efficient purification and analysis techniques. Low pressure-liquid-chromatography systems are essential for the separation and purification of biomolecules, making them indispensable in biopharmaceutical production. The market is anticipated to witness a growth rate of approximately 7% in the coming years, driven by the need for innovative therapies and the rising prevalence of chronic diseases.

Regulatory Compliance Requirements

Regulatory compliance is a critical driver for the low pressure-liquid-chromatography market in South America. As governments and regulatory bodies enforce stringent guidelines for product testing and quality assurance, industries such as food and beverage, pharmaceuticals, and environmental monitoring are compelled to adopt advanced chromatographic techniques. The need for compliance with standards set by organizations like ANVISA in Brazil and INVIMA in Colombia is pushing companies to invest in low pressure-liquid-chromatography systems. This trend is expected to contribute to a market growth of around 5% annually, as businesses prioritize quality control and safety in their operations.

Environmental Monitoring Initiatives

Environmental monitoring initiatives in South America are becoming increasingly important, leading to a heightened demand for low pressure-liquid-chromatography systems. Governments and organizations are focusing on assessing and mitigating pollution levels in air, water, and soil. The adoption of low pressure-liquid-chromatography for analyzing environmental samples is crucial for ensuring compliance with environmental regulations. As a result, the market is projected to grow by about 4.5% annually, as industries and governmental bodies invest in advanced analytical technologies to monitor environmental health and safety.

Technological Integration in Laboratories

The integration of advanced technologies in laboratories across South America is driving the low pressure-liquid-chromatography market. Automation and digitalization are enhancing the efficiency and accuracy of chromatographic processes, making them more accessible to various industries. The adoption of smart laboratory solutions, including data management systems and real-time monitoring, is likely to increase the demand for low pressure-liquid-chromatography systems. This trend suggests a potential market growth of around 6% as laboratories seek to optimize their operations and improve analytical capabilities.