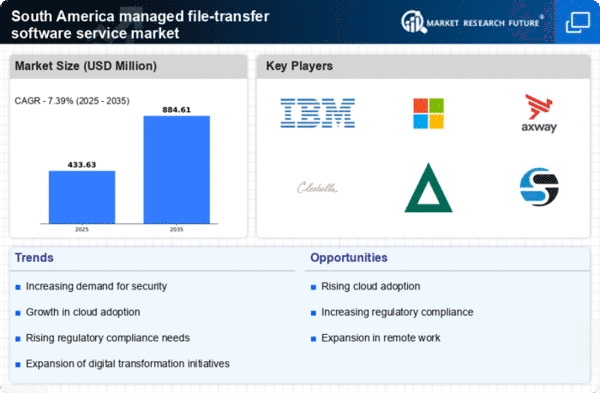

Rising Regulatory Compliance

The increasing emphasis on regulatory compliance in South America is driving the managed file-transfer-software-service market. Organizations are compelled to adhere to various data protection regulations, such as the General Data Protection Regulation (GDPR) and local laws. This compliance necessitates secure and efficient file transfer solutions, which managed file-transfer software can provide. As businesses face potential fines and reputational damage for non-compliance, the demand for these services is likely to grow. In 2025, it is estimated that compliance-related investments in South America could reach $1 billion, further propelling the managed file-transfer-software-service market. Companies are increasingly prioritizing solutions that ensure data integrity and security, thus enhancing the overall market landscape.

Increased Cybersecurity Threats

The rise in cybersecurity threats in South America is significantly influencing the managed file-transfer-software-service market. As cyberattacks become more sophisticated, organizations are prioritizing secure file transfer solutions to protect sensitive data. The need for encryption, authentication, and secure protocols is driving the adoption of managed file-transfer services. In 2025, it is estimated that cybersecurity spending in South America will reach $10 billion, highlighting the urgency for businesses to invest in secure file transfer solutions. This trend indicates a growing awareness of the importance of data security, which is likely to bolster the managed file-transfer-software-service market.

Demand for Enhanced Collaboration Tools

The increasing demand for enhanced collaboration tools in South America is shaping the managed file-transfer-software-service market. As remote work and cross-border collaborations become more prevalent, organizations require efficient file transfer solutions that facilitate teamwork and communication. Managed file-transfer services offer features that support real-time collaboration, version control, and secure sharing of documents. In 2025, the market for collaboration tools in South America is projected to grow by 30%, indicating a strong need for integrated file transfer solutions. This trend suggests that businesses are likely to invest in managed file-transfer software to improve their collaborative efforts, thereby driving market growth.

Growing Digital Transformation Initiatives

Digital transformation initiatives across various sectors in South America are significantly impacting the managed file-transfer-software-service market. As organizations adopt advanced technologies, the need for seamless and secure data exchange becomes paramount. The shift towards digital operations is expected to increase the demand for managed file-transfer solutions, which facilitate efficient data handling and collaboration. In 2025, the digital transformation spending in South America is projected to exceed $50 billion, indicating a robust market for software services that support these initiatives. Companies are likely to invest in managed file-transfer solutions to streamline their operations and enhance productivity, thereby driving market growth.

Expansion of E-commerce and Online Services

The rapid expansion of e-commerce and online services in South America is a key driver for the managed file-transfer-software-service market. As businesses increasingly rely on digital platforms for transactions and customer interactions, the need for secure file transfers becomes critical. E-commerce platforms require efficient data exchange to manage inventory, process payments, and handle customer information securely. In 2025, the e-commerce market in South America is anticipated to grow by 25%, further necessitating robust managed file-transfer solutions. This growth presents opportunities for software providers to cater to the evolving needs of businesses, thereby enhancing the managed file-transfer-software-service market.