Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in South America are significantly impacting the medical bionic-implant-artificial-organs market. Various governments are allocating funds to support research and development in the field of artificial organs. For example, Brazil's Ministry of Health has launched programs to promote innovation in medical technology, which includes bionic implants. This support is crucial as it not only fosters innovation but also encourages collaboration between public institutions and private companies. The financial backing from government sources is expected to increase the market's growth potential, with estimates suggesting a potential increase in market size by 15% over the next few years.

Increasing Demand for Organ Transplants

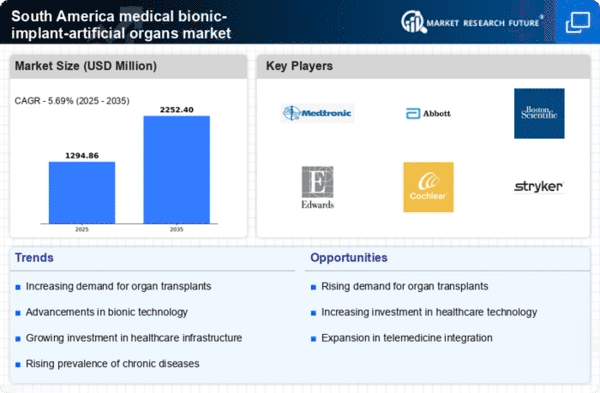

The rising incidence of organ failure in South America has led to an increasing demand for organ transplants. This trend is particularly evident in countries like Brazil and Argentina, where the prevalence of chronic diseases such as diabetes and hypertension is on the rise. The medical bionic-implant-artificial-organs market is responding to this demand by developing advanced bionic organs that can serve as viable alternatives to traditional organ transplants. According to recent estimates, the market for artificial organs in South America is projected to grow at a CAGR of approximately 12% over the next five years, driven by the urgent need for organ replacements and the limitations of donor organ availability.

Technological Innovations in Medical Devices

Technological innovations are playing a pivotal role in the evolution of the medical bionic-implant-artificial-organs market. Advances in materials science, robotics, and bioengineering are enabling the development of more sophisticated and functional bionic organs. For instance, the introduction of biocompatible materials has improved the integration of artificial organs with human tissue, enhancing their performance and longevity. Furthermore, the integration of artificial intelligence in monitoring and managing these devices is expected to enhance patient outcomes. As a result, the market is witnessing a surge in investment, with projections indicating that the sector could reach a valuation of $1 billion by 2027.

Aging Population and Associated Health Issues

The aging population in South America is contributing to a growing prevalence of health issues that necessitate the use of bionic implants and artificial organs. As the demographic shifts towards an older population, the incidence of age-related diseases such as heart failure and renal dysfunction is likely to rise. This demographic trend is creating a substantial market opportunity for the medical bionic-implant-artificial-organs market. Projections indicate that by 2030, the number of individuals aged 65 and older in South America will increase by over 30%, thereby amplifying the demand for innovative medical solutions to address these health challenges.

Rising Awareness and Acceptance of Bionic Solutions

There is a growing awareness and acceptance of bionic solutions among the South American population, which is positively influencing the medical bionic-implant-artificial-organs market. Educational campaigns and success stories of patients benefiting from bionic implants are helping to demystify these technologies. As more individuals become informed about the advantages of artificial organs, including improved quality of life and reduced dependency on traditional treatments, the market is likely to expand. Surveys indicate that approximately 60% of the population in urban areas are open to considering bionic implants as a viable option for organ replacement, suggesting a promising future for the industry.