Growing Focus on Patient-Centric Care

the medical device connectivity market in South America is increasingly aligning with the shift to patient-centric care models. Healthcare providers are recognizing the importance of involving patients in their own care processes, which has led to the development of connected devices that empower patients to monitor their health. This trend is supported by studies indicating that patient engagement can lead to a 20% improvement in health outcomes. By providing patients with tools to track their health data, the medical device-connectivity market is fostering a more collaborative healthcare environment, which is essential for improving overall care quality.

Regulatory Support for Connected Devices

Regulatory frameworks in South America are evolving to support the integration of connected medical devices into healthcare systems. Governments are recognizing the potential of these technologies to enhance healthcare delivery and are implementing policies that facilitate their adoption. For example, streamlined approval processes for connected devices are being established, which could reduce time-to-market by up to 30%. This regulatory support is crucial for the medical device-connectivity market, as it encourages innovation and investment in new technologies, ultimately benefiting patients and healthcare providers alike.

Rising Demand for Remote Patient Monitoring

the medical device connectivity market in South America is experiencing a surge in demand for remote patient monitoring solutions. This trend is driven by an increasing prevalence of chronic diseases, which necessitates continuous health monitoring. According to recent data, approximately 30% of the population in South America suffers from chronic conditions, leading to a heightened need for effective management tools. Remote monitoring devices enable healthcare providers to track patient health metrics in real-time, thereby improving patient outcomes and reducing hospital visits. The integration of these devices into healthcare systems is expected to enhance the efficiency of care delivery, making it a pivotal driver in the medical device-connectivity market.

Technological Advancements in Medical Devices

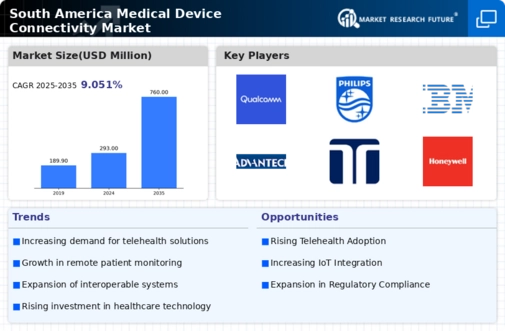

Technological innovations are significantly influencing the medical device-connectivity market in South America. The advent of advanced sensors, wireless communication technologies, and data analytics tools has transformed traditional medical devices into smart, connected solutions. For instance, the introduction of IoT-enabled devices allows for seamless data transmission between patients and healthcare providers. This connectivity not only facilitates timely interventions but also enhances the overall patient experience. As a result, the market is projected to grow at a CAGR of 15% over the next five years, reflecting the increasing integration of technology in healthcare.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is a significant driver for the medical device-connectivity market. Governments and private entities are allocating substantial resources to enhance healthcare facilities and integrate advanced technologies. Recent reports indicate that healthcare spending in the region is expected to reach $200 billion by 2026, with a considerable portion directed towards digital health solutions. This influx of capital is likely to accelerate the adoption of connected medical devices, as improved infrastructure facilitates the implementation of these technologies in clinical settings.