Surge in Surgical Procedures

The surge in surgical procedures across South America significantly impacts the medical disposables market. With an estimated annual growth rate of 5% in surgical interventions, the demand for disposable surgical instruments and supplies is on the rise. This trend is driven by an aging population and an increase in lifestyle-related diseases, which necessitate surgical interventions. Hospitals and surgical centers are increasingly adopting disposable products to minimize infection risks and ensure patient safety. Consequently, the medical disposables market is poised for growth as healthcare providers prioritize efficiency and hygiene in surgical settings.

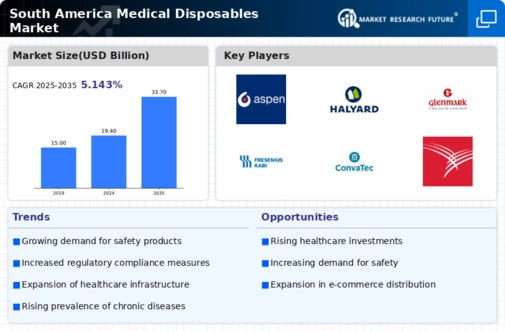

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the medical disposables market. Governments and private sectors are investing more in healthcare infrastructure, which is expected to reach approximately $500 billion by 2026. This increase in funding facilitates the procurement of medical disposables, as healthcare facilities aim to enhance patient care and safety. Moreover, the growing prevalence of chronic diseases necessitates the use of disposable medical products, further propelling market growth. As healthcare budgets expand, the demand for high-quality, cost-effective medical disposables is likely to rise, indicating a robust market trajectory in the region.

Growing Awareness of Infection Control

Growing awareness of infection control measures is a crucial driver for the medical disposables market in South America. Healthcare professionals and institutions are increasingly recognizing the importance of using disposable products to prevent hospital-acquired infections. This awareness is reflected in the rising adoption of single-use items, such as gloves, syringes, and gowns, which are essential for maintaining hygiene standards. As educational campaigns and training programs proliferate, the demand for medical disposables is expected to escalate, potentially leading to a market growth of 8% annually. This trend underscores the critical role of disposables in enhancing patient safety.

Regulatory Support for Healthcare Quality

Regulatory support for healthcare quality is influencing the medical disposables market in South America. Governments are implementing stringent regulations to ensure the safety and efficacy of medical products. This regulatory framework encourages manufacturers to adhere to high-quality standards, thereby enhancing consumer confidence in disposable products. As compliance with these regulations becomes mandatory, manufacturers are likely to invest in quality assurance processes, which may lead to an increase in production costs. However, this investment is expected to yield long-term benefits, as a focus on quality can drive market growth and foster innovation in the medical disposables sector.

Technological Innovations in Product Development

Technological innovations in product development are transforming the medical disposables market in South America. The introduction of advanced materials and manufacturing techniques enhances the functionality and safety of disposable products. For instance, the development of biodegradable disposables is gaining traction, aligning with environmental sustainability goals. Additionally, smart disposables equipped with sensors for monitoring patient health are emerging, indicating a shift towards more integrated healthcare solutions. These innovations not only improve patient outcomes but also attract investments, potentially increasing the market size by 10% over the next few years.

Leave a Comment