Growing Aging Population

The aging population in South America is a significant driver of the medical imaging-workstations market. As the demographic landscape shifts, there is an increasing need for medical services that cater to age-related health issues, which often require advanced imaging techniques for diagnosis and monitoring. The World Health Organization estimates that by 2030, the number of individuals aged 60 and older in South America will reach approximately 200 million. This demographic trend is likely to result in a heightened demand for medical imaging services, thereby propelling the growth of the medical imaging-workstations market. Healthcare providers are expected to invest in modern imaging technologies to accommodate the needs of this growing patient population.

Government Initiatives and Funding

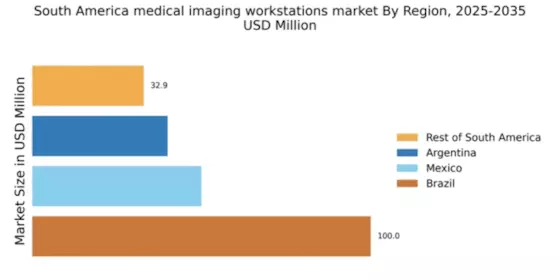

Government initiatives aimed at improving healthcare infrastructure in South America are playing a crucial role in the growth of the medical imaging-workstations market. Various national and regional programs are being implemented to enhance access to advanced medical technologies, including imaging workstations. For instance, funding allocations for healthcare modernization have increased, with some countries committing over $500 million to upgrade medical facilities. These investments are expected to facilitate the acquisition of advanced imaging systems, thereby driving the demand for medical imaging workstations. Furthermore, public-private partnerships are emerging, which could further bolster the market by ensuring that healthcare providers have the necessary resources to implement cutting-edge imaging solutions.

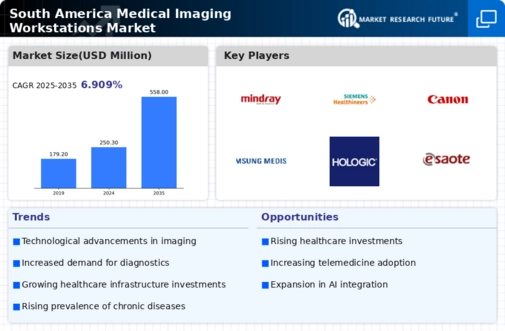

Rising Demand for Diagnostic Imaging

the medical imaging workstations market in South America is experiencing an increase in demand for diagnostic imaging services.. This surge is primarily driven by the growing prevalence of chronic diseases, which necessitate advanced imaging techniques for accurate diagnosis and treatment planning. According to recent data, the incidence of conditions such as cardiovascular diseases and cancer is on the rise, leading healthcare providers to invest in state-of-the-art imaging technologies. As a result, the medical imaging workstations market is expected to expand significantly, with an estimated growth rate of 8% annually over the next five years.. This trend indicates a robust market environment, as healthcare facilities strive to enhance their diagnostic capabilities and improve patient outcomes.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into medical imaging technologies is transforming the landscape of the medical imaging-workstations market in South America. AI algorithms are increasingly being utilized to enhance image analysis, improve diagnostic accuracy, and streamline workflow processes. This technological advancement appears to be gaining traction among healthcare providers, as it can potentially reduce the time required for image interpretation and increase the efficiency of radiologists. Reports suggest that the adoption of AI in imaging could lead to a 30% reduction in diagnostic errors, thereby improving patient care. As healthcare facilities recognize the benefits of AI integration, the demand for advanced medical imaging workstations equipped with these capabilities is likely to rise significantly.

Rising Awareness of Preventive Healthcare

There is a growing awareness of preventive healthcare among the South American population, which is influencing the medical imaging-workstations market. As individuals become more health-conscious, there is an increasing emphasis on early detection and prevention of diseases. This shift in mindset is prompting healthcare providers to offer more comprehensive imaging services, which are essential for preventive care. Market data indicates that the demand for preventive imaging services has increased by approximately 15% in recent years. Consequently, healthcare facilities are likely to invest in advanced medical imaging workstations to meet this rising demand, thereby contributing to the overall growth of the market.