South America Medical Nitrile Gloves Market Summary

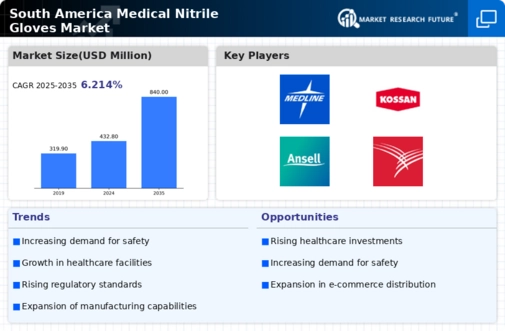

As per Market Research Future analysis, the South America medical nitrile-gloves market Size was estimated at 190.0 $ Million in 2024. The South America medical nitrile-gloves market is projected to grow from 202.35 $ Million in 2025 to 380.0 $ Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The South America medical nitrile-gloves market is experiencing robust growth driven by quality demands and regulatory changes.

- Brazil remains the largest market for medical nitrile gloves, reflecting a strong demand for quality products.

- Mexico is emerging as the fastest-growing region, indicating a shift towards increased healthcare investments.

- Regulatory enhancements are shaping the market landscape, pushing manufacturers to comply with higher standards.

- Key drivers such as rising healthcare expenditure and increasing awareness of infection control are propelling market growth.

Market Size & Forecast

| 2024 Market Size | 190.0 (USD Million) |

| 2035 Market Size | 380.0 (USD Million) |

| CAGR (2025 - 2035) | 6.5% |

Major Players

Top Glove Corporation Berhad (MY), Hartalega Holdings Berhad (MY), Kossan Rubber Industries Bhd (MY), Ansell Limited (AU), Supermax Corporation Berhad (MY), Semperit AG Holding (AT), Rubberex Corporation (M) Berhad (MY), Medline Industries, Inc. (US), MediGrip (IN)