Growing Health Consciousness

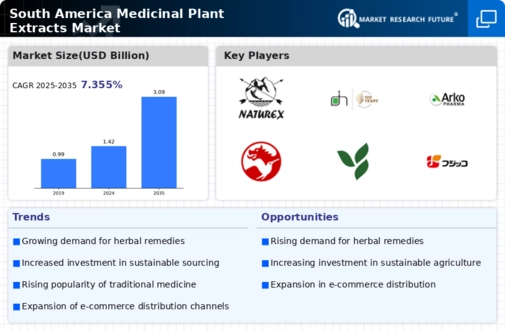

The increasing awareness of health and wellness among consumers in South America appears to be a pivotal driver for the medicinal plant-extracts market. As individuals become more informed about the benefits of natural remedies, there is a notable shift towards herbal products. This trend is reflected in the rising sales of herbal supplements, which reportedly reached approximately $1.5 billion in 2024. Consumers are increasingly seeking alternatives to synthetic pharmaceuticals, which may lead to a sustained growth trajectory for the medicinal plant-extracts market. Furthermore, the demand for organic and non-GMO products is likely to enhance the appeal of plant-based extracts, as consumers prioritize health and sustainability in their purchasing decisions.

Innovation in Extraction Technologies

Advancements in extraction technologies are likely to play a crucial role in shaping the medicinal plant-extracts market in South America. Innovative methods such as supercritical fluid extraction and ultrasonic extraction are enhancing the efficiency and yield of plant extracts. These technologies not only improve the quality of the extracts but also reduce production costs, making them more accessible to manufacturers. As the market for plant-based products continues to expand, the adoption of these advanced extraction techniques could potentially lead to a more competitive landscape, fostering growth and diversification within the medicinal plant-extracts market.

Rising Popularity of Functional Foods

The trend towards functional foods in South America is emerging as a significant driver for the medicinal plant-extracts market. Consumers are increasingly seeking foods that offer health benefits beyond basic nutrition, and plant extracts are often incorporated into these products. The functional food market is projected to grow at a CAGR of 8% from 2025 to 2030, indicating a robust demand for ingredients that promote health and wellness. This trend may lead to an increased utilization of medicinal plant extracts in food and beverage formulations, thereby expanding the market reach and enhancing product offerings.

Regulatory Support for Herbal Products

The regulatory landscape in South America is evolving to support the medicinal plant-extracts market. Governments are increasingly recognizing the therapeutic potential of herbal products, leading to the establishment of guidelines and standards for their use. This regulatory support may enhance consumer confidence and encourage investment in the sector. For instance, the establishment of quality control measures and certification processes could potentially increase the market value of herbal extracts, which was estimated at $2 billion in 2024. As regulations become more favorable, it is likely that more companies will enter the market, further driving innovation and product development.

Cultural Heritage and Traditional Practices

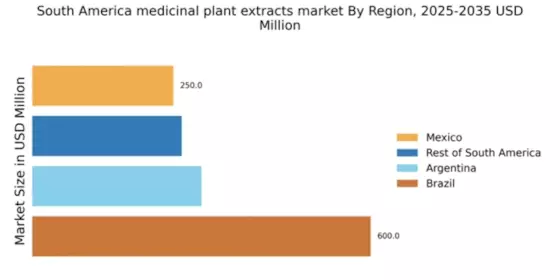

In South America, the rich cultural heritage and traditional medicinal practices significantly influence the medicinal plant-extracts market. Indigenous communities have utilized various plant extracts for centuries, and this knowledge is increasingly being recognized and valued. The revival of interest in traditional medicine, coupled with the integration of these practices into modern healthcare, suggests a potential growth area for the market. Reports indicate that traditional herbal medicine accounts for nearly 30% of the healthcare practices in some regions. This cultural significance not only drives demand but also encourages the preservation of biodiversity, as more consumers seek authentic and locally sourced plant extracts.