Enhanced Focus on Security

In the context of the microservices architecture market in South America, security has emerged as a paramount concern for organizations. With the increasing frequency of cyber threats, businesses are compelled to adopt architectures that offer robust security features. Microservices, by their nature, allow for the implementation of security protocols at various levels, thereby enhancing overall system security. Recent studies indicate that approximately 40% of South American companies are prioritizing security in their IT investments, which is likely to drive the adoption of microservices architectures. This heightened focus on security not only protects sensitive data but also fosters customer trust, ultimately contributing to the growth of the microservices architecture market in the region.

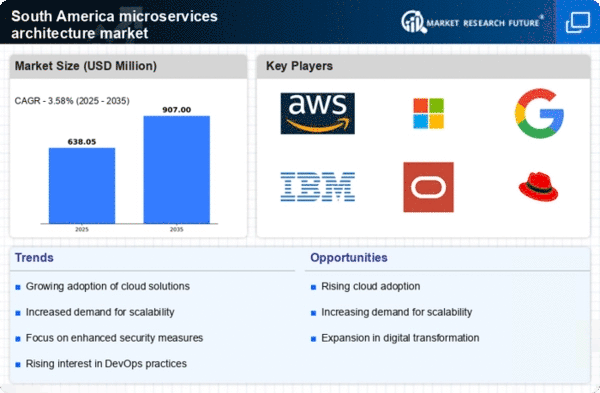

Growing Demand for Scalability

the microservices architecture market in South America is experiencing a surge in demand for scalability solutions.. As businesses expand, they require systems that can efficiently handle increased workloads without compromising performance. This demand is particularly pronounced in sectors such as e-commerce and finance, where rapid growth necessitates agile and scalable IT infrastructures. According to recent data, the scalability needs of enterprises in South America are projected to grow by approximately 30% over the next five years. This trend indicates a shift towards microservices as organizations seek to enhance their operational efficiency and responsiveness to market changes. Consequently, the microservices architecture market is likely to benefit from this growing emphasis on scalable solutions, making it a critical component of modern IT strategies..

Integration of IoT Technologies

The integration of Internet of Things (IoT) technologies is significantly influencing the microservices architecture market in South America. As IoT devices proliferate, the need for architectures that can seamlessly integrate and manage these devices becomes increasingly critical. Microservices architecture offers the flexibility and modularity required to support diverse IoT applications, enabling businesses to innovate and respond to market demands effectively. Current estimates suggest that the IoT market in South America is expected to reach $15 billion by 2026, which could further propel the microservices architecture market as organizations seek to leverage IoT capabilities. This integration not only enhances operational efficiency but also opens new avenues for revenue generation, making it a vital driver in the region.

Rising Investment in IT Infrastructure

Investment in IT infrastructure is a critical driver for the microservices architecture market in South America. As businesses recognize the importance of modernizing their IT systems, there is a marked increase in funding directed towards upgrading infrastructure to support microservices. This trend is particularly evident in sectors such as telecommunications and finance, where legacy systems are being replaced with more flexible and efficient architectures. Recent data indicates that IT spending in South America is projected to grow by 8% annually, with a significant portion allocated to microservices-related technologies. This rising investment not only facilitates the adoption of microservices but also enhances overall business agility and competitiveness in the market.

Shift Towards Agile Development Practices

the microservices architecture market in South America is witnessing a shift towards agile development practices, reshaping software development and deployment.. Organizations are increasingly adopting agile methodologies to enhance collaboration, speed up delivery, and improve product quality. Microservices architecture aligns well with these practices, allowing teams to work on independent services that can be developed, tested, and deployed autonomously. This trend is reflected in the growing number of software development firms in South America that are embracing agile frameworks, with an estimated 50% of companies reporting a transition to agile methodologies. As agile practices become more prevalent, the microservices architecture market is likely to expand, driven by the need for faster and more efficient software development processes.