Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in South America is a pivotal driver for the migraine drugs market. Governments and private sectors are investing in healthcare facilities and services, improving access to medical care for migraine sufferers. Enhanced healthcare access allows for better diagnosis and treatment of migraines, leading to increased prescriptions of migraine medications. Additionally, the integration of pharmacies within healthcare systems facilitates the availability of these drugs. As a result, the market is likely to experience growth, with an estimated increase of 5% in drug sales over the next few years, reflecting the positive impact of improved healthcare infrastructure.

Advancements in Pharmaceutical Research

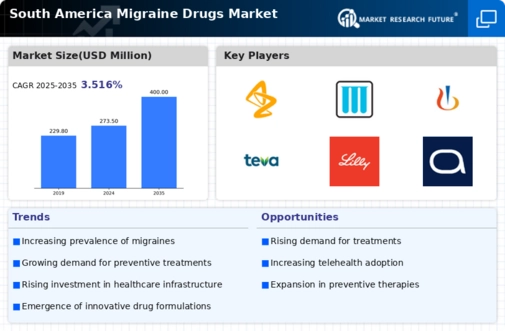

Innovations in pharmaceutical research are significantly impacting the migraine drugs market in South America. The development of novel drug formulations and delivery systems has enhanced the efficacy and safety profiles of migraine treatments. For instance, the introduction of CGRP inhibitors has revolutionized the management of migraines, providing patients with new options. The South American market is witnessing a surge in clinical trials aimed at evaluating the effectiveness of these new therapies. As a result, the market is projected to grow at a CAGR of 7% over the next five years, driven by these advancements. This trend indicates a promising future for both patients and pharmaceutical companies.

Increasing Incidence of Migraine Disorders

The rising prevalence of migraine disorders in South America is a crucial driver for the migraine drugs market. Recent studies indicate that approximately 15% of the population in this region suffers from migraines, leading to a growing demand for effective treatment options. This increasing incidence is likely to spur pharmaceutical companies to invest in research and development of new migraine medications. Furthermore, the economic burden associated with migraines, estimated at $2.5 billion annually in lost productivity, underscores the need for effective therapies. As awareness of migraine disorders grows, healthcare providers are more inclined to prescribe specialized treatments, thereby expanding the market for migraine drugs.

Growing Awareness and Education Initiatives

In South America, increasing awareness and education initiatives regarding migraine disorders are driving the migraine drugs market. Healthcare organizations and advocacy groups are actively promoting understanding of migraine symptoms and treatment options. This heightened awareness is likely to lead to earlier diagnosis and treatment, which can improve patient outcomes. As more individuals recognize the impact of migraines on their quality of life, the demand for effective medications is expected to rise. Consequently, this trend may contribute to a market growth rate of approximately 6% annually, as patients seek appropriate therapies to manage their conditions.

Rising Adoption of Digital Health Solutions

The rising adoption of digital health solutions is transforming the migraine drugs market in South America. Telehealth services and mobile health applications are becoming increasingly popular, enabling patients to consult healthcare professionals remotely. This trend is particularly beneficial for individuals with migraines, as it allows for timely access to care and medication management. The convenience of digital platforms is likely to enhance patient adherence to treatment regimens, thereby increasing the demand for migraine drugs. As digital health solutions continue to evolve, the market may see a growth rate of around 8% in the coming years, driven by this technological advancement.