Expansion of Vaccination Programs

The expansion of vaccination programs across South America is a critical driver for the needle free-injection market. Governments and health organizations are increasingly focusing on immunization initiatives to combat infectious diseases. The needle-free injectors offer a promising alternative to traditional syringes, as they reduce the risk of needle-stick injuries and improve the efficiency of vaccine delivery. Recent data suggests that the vaccination rates in South America have increased by over 20% in the last few years, further emphasizing the need for innovative delivery methods. As vaccination campaigns continue to evolve, the needle free-injection market is likely to benefit from heightened demand for safe and effective immunization solutions.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases in South America is a significant driver for the needle free-injection market. Conditions such as diabetes, hypertension, and cardiovascular diseases require regular medication, often necessitating frequent injections. The discomfort associated with traditional needles can deter patient compliance, making needle-free injectors an attractive alternative. Current data suggests that chronic disease prevalence in the region has increased by over 15% in recent years, underscoring the urgent need for innovative delivery methods. As healthcare providers seek to improve patient adherence to treatment regimens, the adoption of needle-free technologies is expected to rise, thereby positively impacting the needle free-injection market.

Increasing Focus on Preventive Healthcare

The increasing focus on preventive healthcare in South America is driving the needle free-injection market. As healthcare systems prioritize prevention over treatment, there is a growing emphasis on vaccination and early intervention strategies. Needle-free injectors align well with this paradigm shift, offering a user-friendly and efficient method for administering vaccines and medications. Recent statistics indicate that preventive healthcare spending in South America has risen by approximately 10% annually, reflecting a broader commitment to improving public health outcomes. This trend is likely to bolster the demand for needle-free technologies, as they facilitate easier access to preventive measures, thereby enhancing the overall effectiveness of healthcare initiatives.

Technological Innovations in Drug Delivery

Technological innovations in drug delivery systems are significantly influencing the needle free-injection market in South America. The development of advanced needle-free devices, which utilize high-pressure technology to deliver medications, is gaining traction among healthcare providers. These innovations not only enhance the precision of drug delivery but also improve patient comfort. Market analysis indicates that the adoption of these technologies could lead to a reduction in overall healthcare costs by minimizing complications associated with traditional injections. As healthcare systems in South America strive for efficiency and effectiveness, the integration of cutting-edge needle-free technologies is expected to play a pivotal role in shaping the future of the needle free-injection market.

Rising Demand for Pain Management Solutions

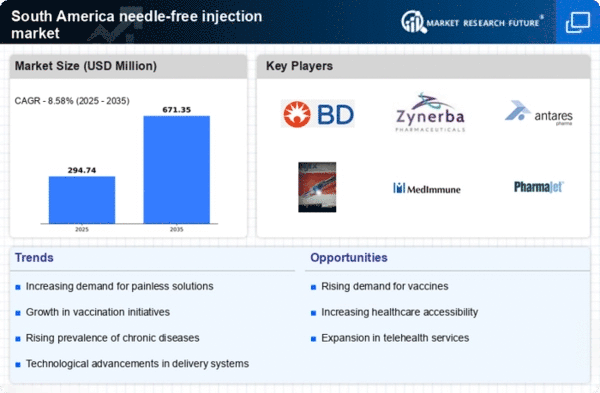

The needle free-injection market in South America is experiencing a notable surge in demand for effective pain management solutions. Patients increasingly prefer methods that minimize discomfort, leading to a shift towards needle-free technologies. This trend is particularly pronounced in the context of chronic conditions, where patients require frequent medication administration. The market data indicates that the demand for needle-free injectors is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for innovative solutions that enhance patient compliance and satisfaction. As healthcare providers seek to improve treatment outcomes, the adoption of needle-free technologies is likely to become a standard practice in pain management, thereby significantly impacting the needle free-injection market.