Increased Focus on Regulatory Compliance

The nicotine oral-dissolvable-thin-films market in South America is significantly influenced by the increased focus on regulatory compliance. Governments in the region are implementing stricter regulations regarding the marketing and sale of nicotine products, which has prompted manufacturers to ensure their offerings meet these standards. Compliance not only enhances product credibility but also fosters consumer trust. As regulations evolve, companies that proactively adapt to these changes are likely to gain a competitive edge. This emphasis on regulatory adherence may lead to a more structured market environment, potentially resulting in a 10% increase in market stability and consumer confidence over the next few years.

Rising Disposable Income Among Consumers

The nicotine oral-dissolvable-thin-films market in South America is likely to benefit from the rising disposable income of consumers. As economic conditions improve, individuals are increasingly willing to invest in premium products that align with their lifestyle choices. This trend is particularly evident in urban areas where consumers are more exposed to health and wellness trends. The willingness to spend on innovative nicotine delivery systems indicates a shift in consumer behavior, favoring quality over quantity. Market analysts suggest that this increase in disposable income could lead to a growth rate of around 6% in the segment over the next few years, as consumers prioritize products that offer convenience and health benefits.

Growing Influence of E-commerce Platforms

The nicotine oral-dissolvable-thin-films market in South America is witnessing a transformation due to the growing influence of e-commerce platforms. Online retailing provides consumers with easy access to a variety of products, enabling them to explore options that may not be available in traditional brick-and-mortar stores. This shift towards digital shopping is particularly appealing to younger demographics who prefer the convenience of online purchases. As e-commerce continues to expand, it is expected to account for a larger share of the market, potentially increasing sales by 15% over the next few years. This trend indicates that manufacturers must adapt their distribution strategies to leverage the benefits of online sales channels.

Increasing Demand for Smoking Alternatives

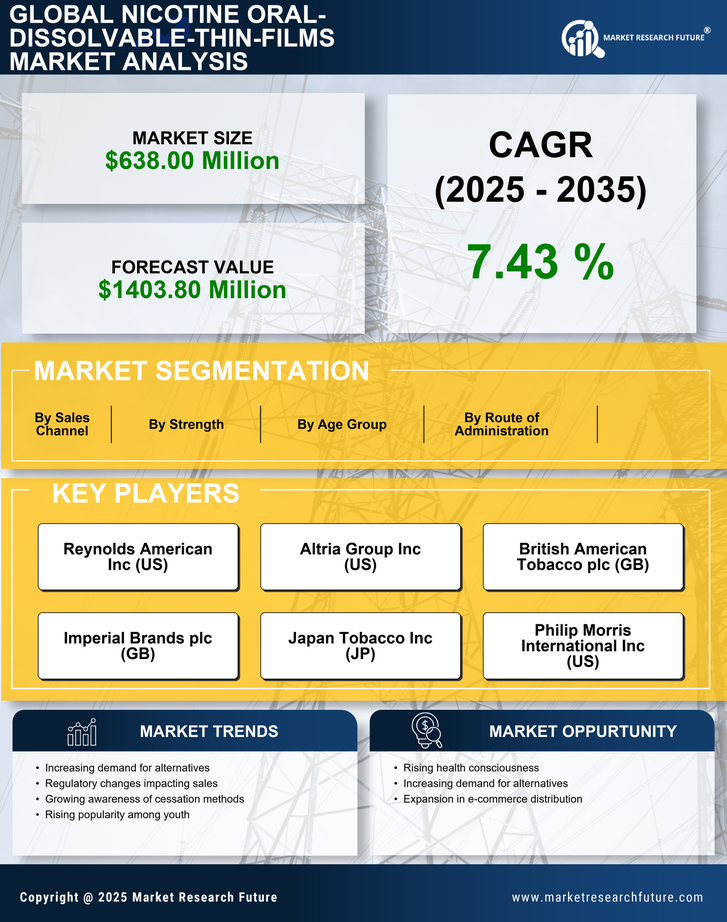

The nicotine oral-dissolvable-thin-films market in South America is experiencing a notable surge in demand as consumers increasingly seek alternatives to traditional smoking. This shift is largely driven by a growing awareness of the health risks associated with smoking, prompting individuals to explore less harmful options. According to recent data, the market for nicotine alternatives is projected to grow at a CAGR of approximately 8% over the next five years. This trend indicates a significant opportunity for manufacturers to cater to a health-conscious demographic that is actively seeking innovative products. The convenience and discreet nature of oral-dissolvable films further enhance their appeal, making them a preferred choice among consumers looking to reduce their nicotine intake without the drawbacks of conventional tobacco products.

Technological Advancements in Product Development

Technological innovations play a crucial role in shaping the nicotine oral-dissolvable-thin-films market in South America. Advances in formulation and manufacturing processes have led to the development of more effective and palatable products. For instance, improvements in film solubility and flavoring techniques have enhanced user experience, making these products more appealing to a broader audience. The market is witnessing an influx of new entrants leveraging cutting-edge technology to create unique offerings. As a result, the competitive landscape is evolving, with established players and startups alike striving to capture market share. This dynamic environment suggests that ongoing research and development will be pivotal in driving growth and meeting the diverse preferences of consumers in the region.