Brazil : Leading Market Share and Growth Drivers

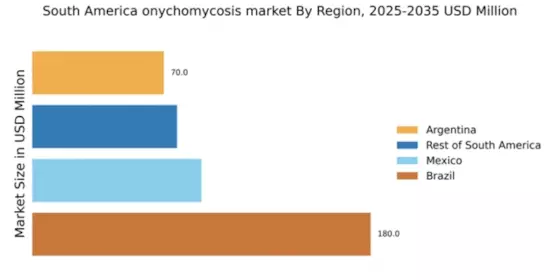

Brazil holds a commanding market share of 45% in the South American onychomycosis market, valued at $180.0 million. Key growth drivers include increasing awareness of fungal infections, rising disposable incomes, and a growing elderly population. Demand trends indicate a shift towards topical treatments, supported by government initiatives promoting healthcare access. Regulatory policies are becoming more favorable, with streamlined approval processes for antifungal medications, enhancing market dynamics. Infrastructure improvements in healthcare facilities further bolster industrial development in this sector. Key cities such as São Paulo and Rio de Janeiro are pivotal markets, showcasing a competitive landscape dominated by major players like Bayer AG and Johnson & Johnson. The presence of local manufacturers also intensifies competition, fostering innovation in treatment options. The business environment is characterized by a mix of established pharmaceutical companies and emerging startups, focusing on both prescription and over-the-counter products. The dermatological sector is particularly active, with a growing emphasis on preventive care and patient education.

Mexico : Increasing Demand for Antifungal Treatments

Mexico accounts for 22.5% of the South American onychomycosis market, valued at $90.0 million. The market is driven by a rising prevalence of fungal infections, particularly in urban areas, and increasing healthcare expenditure. Demand for effective antifungal treatments is on the rise, supported by government health campaigns aimed at educating the public about onychomycosis. Regulatory frameworks are evolving, with efforts to expedite the approval of new treatments, enhancing market accessibility. Infrastructure improvements in healthcare facilities are also contributing to market growth. Key markets include Mexico City and Guadalajara, where the competitive landscape features significant players like Novartis AG and Pfizer Inc. The presence of local distributors and pharmacies enhances product availability, while the business environment is becoming increasingly favorable for new entrants. The dermatology sector is witnessing innovation, with a focus on developing combination therapies and patient-centric solutions to improve treatment adherence and outcomes.

Argentina : Regulatory Support and Market Dynamics

Argentina holds a market share of 17.5%, valued at $70.0 million in the onychomycosis sector. Key growth drivers include an increasing awareness of fungal infections and a rise in healthcare spending. Demand trends show a preference for topical treatments, supported by government initiatives aimed at improving public health. Regulatory policies are becoming more supportive, with streamlined processes for drug approvals, which is crucial for market expansion. The development of healthcare infrastructure is also enhancing access to treatments across the country. Buenos Aires and Córdoba are key markets, with a competitive landscape featuring major players like GlaxoSmithKline plc and Merck & Co., Inc. The local market dynamics are characterized by a mix of international and domestic companies, fostering a competitive environment. The business climate is improving, with a focus on innovative treatment options and patient education initiatives. The dermatological sector is particularly active, with increasing collaboration between healthcare providers and pharmaceutical companies to enhance treatment accessibility.

Rest of South America : Varied Demand Across Sub-regions

The Rest of South America represents a market share of 19.25%, valued at $77.0 million in the onychomycosis market. Key growth drivers include rising awareness of fungal infections and increasing healthcare access in countries like Chile and Colombia. Demand trends indicate a growing preference for both prescription and over-the-counter treatments, supported by government health initiatives. Regulatory policies vary by country, with some regions experiencing faster approval processes for antifungal medications, which is crucial for market growth. Infrastructure development is uneven, impacting market dynamics across the region. Key markets include Santiago and Bogotá, where the competitive landscape features a mix of local and international players, including AbbVie Inc. and Astellas Pharma Inc. The business environment is diverse, with varying levels of market maturity and regulatory support. The dermatology sector is evolving, with a focus on improving treatment options and patient access, driven by local healthcare policies and initiatives aimed at combating fungal infections.

Leave a Comment