Rising Demand for Telehealth Services

The patient access market in South America is experiencing a notable increase in demand for telehealth services. This trend is driven by the growing need for accessible healthcare, particularly in remote areas where traditional healthcare facilities may be limited. According to recent data, telehealth utilization has surged by approximately 30% in the region, indicating a shift in patient preferences towards virtual consultations. This shift not only enhances patient access but also reduces the burden on healthcare systems. As a result, healthcare providers are increasingly investing in telehealth technologies, which are becoming integral to the patient access-solutions market. The expansion of internet connectivity and mobile technology further supports this trend, allowing patients to engage with healthcare providers more conveniently and efficiently.

Increasing Focus on Preventive Healthcare

The patient access market in South America is witnessing a growing emphasis on preventive healthcare measures. This shift is largely driven by rising awareness of the importance of early detection and management of health conditions. Public health campaigns aimed at educating the population about preventive care are becoming more common, leading to increased participation in screenings and wellness programs. Data suggests that preventive healthcare initiatives can reduce overall healthcare costs by up to 25%, making them an attractive option for both patients and healthcare providers. As a result, the patient access-solutions market is adapting to meet the needs of a more health-conscious population, with services that facilitate access to preventive care becoming increasingly vital.

Collaboration Between Public and Private Sectors

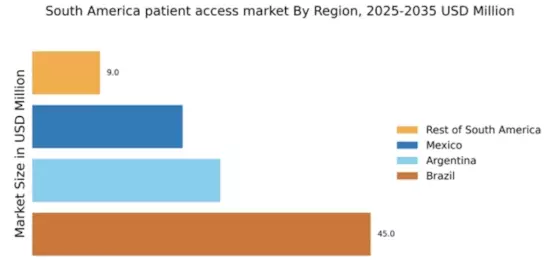

Collaboration between public and private sectors is emerging as a key driver in the patient access-solutions market in South America. This partnership model is fostering innovation and improving service delivery by leveraging the strengths of both sectors. Public entities often provide the regulatory framework and funding, while private companies contribute technological expertise and efficiency. Recent initiatives have shown that such collaborations can enhance patient access to healthcare services, particularly in rural areas where resources are scarce. The patient access-solutions market is likely to benefit from this synergy, as it encourages the development of tailored solutions that address specific regional challenges. This collaborative approach may lead to a more sustainable healthcare ecosystem, ultimately improving patient outcomes.

Technological Advancements in Healthcare Delivery

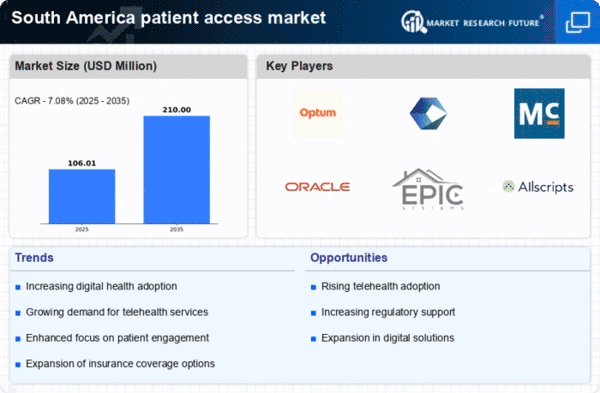

Technological advancements are playing a crucial role in shaping the patient access-solutions market in South America. Innovations such as electronic health records (EHRs), mobile health applications, and artificial intelligence (AI) are streamlining healthcare delivery and improving patient engagement. The integration of EHRs has been shown to enhance communication between healthcare providers, leading to better patient outcomes. Furthermore, mobile health applications are empowering patients to manage their health proactively, which is particularly important in a region where health literacy varies widely. As these technologies become more widespread, the patient access-solutions market is expected to expand, with a projected growth rate of around 20% over the next five years. This growth is indicative of a broader trend towards digitization in healthcare, which is likely to continue reshaping the landscape.

Government Initiatives for Healthcare Accessibility

In South America, various government initiatives aimed at improving healthcare accessibility are significantly influencing the patient access-solutions market. Governments are implementing policies that promote equitable access to healthcare services, particularly for underserved populations. For instance, initiatives that subsidize healthcare costs or provide free services to low-income individuals are becoming more prevalent. These efforts are reflected in the increasing allocation of public health budgets, which have risen by approximately 15% in recent years. Such government support not only enhances patient access but also encourages private sector participation in the healthcare market. Consequently, the patient access-solutions market is likely to benefit from a more collaborative approach between public and private entities, fostering innovation and improving service delivery.