Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the pegylated drugs market in South America. The region has witnessed a surge in biopharmaceutical research and development, leading to the creation of novel pegylated therapies. These advancements facilitate the development of drugs with improved pharmacokinetic profiles, which are crucial for treating complex diseases. For example, the market for pegylated interferons has expanded, driven by their effectiveness in treating hepatitis C. The South American biopharmaceutical sector is expected to grow at a CAGR of around 8% over the next few years, indicating a robust environment for the development of pegylated drugs. This growth is likely to enhance the availability of innovative treatments, thereby driving market expansion.

Government Initiatives and Funding

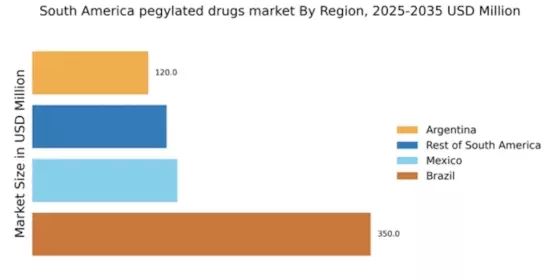

Government initiatives aimed at enhancing healthcare infrastructure and funding for drug development are crucial drivers for the pegylated drugs market in South America. Various governments are investing in healthcare reforms and providing financial support for research in biopharmaceuticals. For instance, Brazil's government has allocated approximately $500 million for biotechnology research, which includes the development of pegylated drugs. Such initiatives not only foster innovation but also create a conducive environment for the commercialization of new therapies. The increased funding is likely to accelerate the development and approval processes for pegylated drugs, thereby expanding their market presence in the region.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South America is a pivotal driver for the pegylated drugs market. Conditions such as diabetes, cancer, and autoimmune disorders are becoming more prevalent, necessitating advanced therapeutic options. For instance, the prevalence of diabetes in South America is projected to reach approximately 10% by 2030. Pegylated drugs, known for their extended half-life and reduced immunogenicity, are increasingly being utilized to manage these conditions effectively. This trend indicates a growing market potential, as healthcare providers seek innovative solutions to improve patient outcomes. The demand for pegylated formulations is likely to surge, as they offer enhanced efficacy and convenience, aligning with the healthcare goals of managing chronic diseases more effectively.

Growing Awareness and Acceptance of Biologics

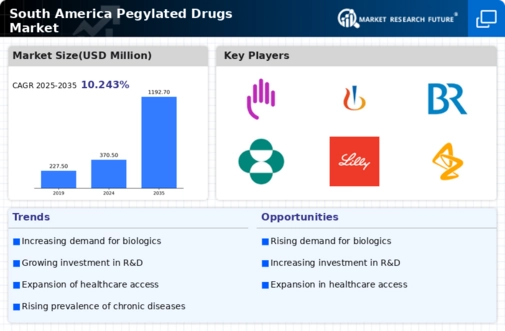

The growing awareness and acceptance of biologics among healthcare professionals and patients are driving the pegylated drugs market in South America. As healthcare providers become more informed about the benefits of biologics, including pegylated formulations, there is a noticeable shift towards prescribing these therapies. This trend is supported by educational initiatives and marketing efforts from pharmaceutical companies. The market for biologics in South America is anticipated to grow at a CAGR of 10% over the next five years, reflecting an increasing preference for advanced therapeutic options. This acceptance is likely to enhance the adoption of pegylated drugs, as they are recognized for their efficacy and safety profiles.

Rising Investment in Research and Development

Rising investment in research and development (R&D) within the pharmaceutical sector is a significant driver for the pegylated drugs market in South America. Pharmaceutical companies are increasingly allocating resources to develop innovative pegylated therapies that address unmet medical needs. The region has seen a notable increase in R&D spending, with estimates suggesting a growth of around 15% annually. This investment is crucial for advancing the science behind pegylation and improving drug formulations. As companies strive to bring new pegylated drugs to market, the competitive landscape is likely to intensify, fostering innovation and potentially leading to breakthroughs in treatment options for various diseases.