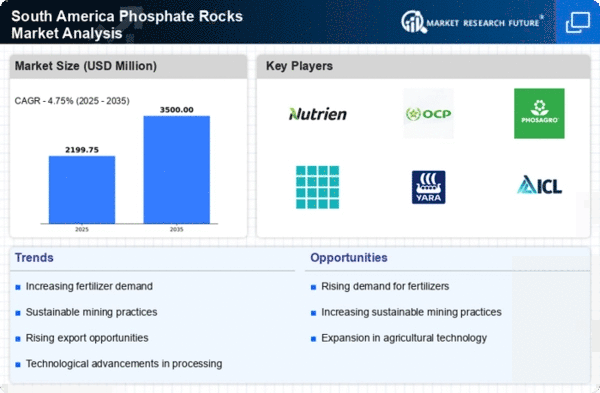

Rising Export Opportunities

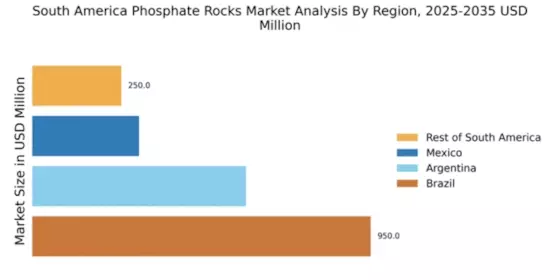

The phosphate rocks market in South America is poised to benefit from increasing export opportunities. Countries such as Brazil and Peru are recognized for their rich phosphate rock reserves, which can be leveraged to meet international demand. In 2025, it is anticipated that South American phosphate rock exports could rise by 15%, driven by growing markets in Asia and Europe. This trend suggests that local producers may focus on enhancing their production capabilities to cater to global buyers. As a result, the phosphate rocks market is likely to see a surge in investment aimed at expanding mining operations and improving logistics to facilitate exports.

Increasing Agricultural Production

The growing need for enhanced agricultural output in South America is a primary driver for the phosphate rocks market. As countries in the region strive to meet food security demands, the use of phosphate rocks as a key ingredient in fertilizers becomes increasingly vital. In 2025, the agricultural sector in South America is projected to expand by approximately 3.5%, leading to a heightened demand for phosphate-based fertilizers. This trend indicates that farmers are likely to rely more on phosphate rocks to improve soil fertility and crop yields. Consequently, the phosphate rocks market is expected to experience significant growth as agricultural practices evolve to incorporate more efficient nutrient management strategies.

Technological Innovations in Mining

Technological advancements in mining techniques are likely to play a crucial role in shaping the phosphate rocks market in South America. Innovations such as automation, data analytics, and improved extraction methods are enhancing operational efficiency and reducing costs. In 2025, it is projected that the adoption of advanced mining technologies could lower production costs by up to 12%, making phosphate rock extraction more economically viable. This trend suggests that companies investing in technology will gain a competitive edge, potentially leading to increased market share. As a result, the phosphate rocks market may experience accelerated growth driven by enhanced productivity and reduced environmental impact.

Government Policies Supporting Fertilizer Use

Government initiatives aimed at boosting agricultural productivity in South America are likely to bolster the phosphate rocks market. Various countries are implementing policies that encourage the use of fertilizers, including those derived from phosphate rocks. For instance, subsidies for fertilizer purchases and investments in agricultural research are becoming more common. In 2025, it is estimated that government spending on agricultural support in South America will increase by 10%, further driving the demand for phosphate-based fertilizers. This supportive regulatory environment is expected to enhance the phosphate rocks market, as farmers seek to optimize their yields through improved nutrient application.

Environmental Regulations and Sustainable Practices

The phosphate rocks market is influenced by the increasing emphasis on environmental regulations in South America. As governments and organizations prioritize sustainable mining practices, companies are compelled to adopt more environmentally friendly methods of phosphate extraction. In 2025, it is expected that compliance costs related to environmental regulations will rise by 8%, prompting firms to innovate and invest in cleaner technologies. This shift may lead to a more sustainable phosphate rocks market, as companies strive to balance profitability with ecological responsibility. The adoption of sustainable practices could also enhance the market's reputation, attracting environmentally conscious consumers and investors.