Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in South America significantly influence the physical therapy-equipment market. Various countries in the region are increasing their healthcare budgets, with a focus on rehabilitation services. For instance, recent reports indicate that public spending on health has risen by over 15% in several South American nations. This financial support often translates into enhanced access to physical therapy services and the procurement of necessary equipment. Additionally, government programs promoting preventive care and rehabilitation are likely to stimulate demand for physical therapy equipment. The physical therapy-equipment market stands to benefit from these initiatives, as they create opportunities for manufacturers and suppliers to expand their reach and improve service delivery.

Growing Awareness of Rehabilitation Benefits

There is a notable increase in awareness regarding the benefits of rehabilitation and physical therapy among the South American population. Educational campaigns and advocacy efforts have contributed to a shift in public perception, highlighting the importance of recovery and rehabilitation in overall health management. As a result, more individuals are seeking physical therapy services, which in turn drives demand for related equipment. Market data indicates that the demand for physical therapy equipment has increased by approximately 20% in the last few years, reflecting this growing awareness. The physical therapy-equipment market is likely to capitalize on this trend by promoting the effectiveness of their products in enhancing recovery and improving quality of life for patients.

Rising Incidence of Musculoskeletal Disorders

The increasing prevalence of musculoskeletal disorders in South America is a primary driver for the physical therapy-equipment market. Conditions such as arthritis, back pain, and sports injuries are becoming more common, leading to a higher demand for effective rehabilitation solutions. According to recent health statistics, approximately 30% of the population in certain South American countries report chronic pain related to musculoskeletal issues. This trend necessitates the availability of specialized equipment to aid in recovery and rehabilitation. As healthcare providers seek to improve patient outcomes, investments in advanced physical therapy equipment are likely to rise, thereby propelling market growth. The physical therapy-equipment market must adapt to these changing needs by offering innovative solutions tailored to the specific requirements of patients suffering from these disorders.

Aging Population and Increased Healthcare Needs

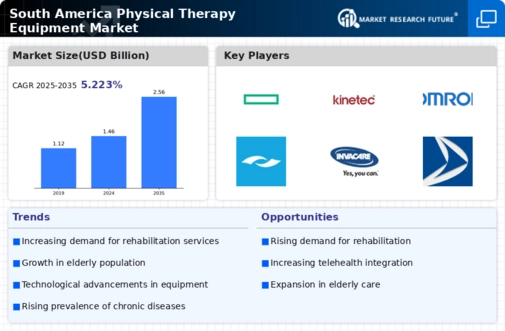

The demographic shift towards an aging population in South America is a crucial driver for the physical therapy-equipment market. As the proportion of elderly individuals rises, there is a corresponding increase in age-related health issues, including mobility impairments and chronic conditions. Projections suggest that by 2030, the elderly population in South America will account for over 15% of the total population. This demographic change necessitates a greater focus on rehabilitation and physical therapy services, thereby driving demand for specialized equipment. The physical therapy-equipment market must respond to this growing need by developing products that cater to the unique challenges faced by older adults, ensuring they receive the necessary support for maintaining their health and mobility.

Technological Integration in Rehabilitation Practices

The integration of advanced technologies into rehabilitation practices is transforming the physical therapy-equipment market. Innovations such as telehealth, wearable devices, and smart equipment are becoming increasingly prevalent in South America. These technologies not only enhance the effectiveness of physical therapy but also improve patient engagement and adherence to treatment plans. Recent studies suggest that the use of technology in rehabilitation can lead to a 25% improvement in patient outcomes. As healthcare providers adopt these technologies, the demand for compatible physical therapy equipment is expected to rise. The physical therapy-equipment market must stay abreast of these technological advancements to remain competitive and meet the evolving needs of healthcare providers and patients.