Increasing Data Generation

The rapid increase in data generation across various sectors in South America is a primary driver for the portable data-storage market. With the proliferation of smartphones, IoT devices, and digital content creation, the volume of data produced is staggering. For instance, it is estimated that data generation in the region could reach 44 zettabytes by 2025. This surge necessitates efficient storage solutions, propelling demand for portable data-storage devices. As businesses and individuals seek to manage and back up their data effectively, the portable data-storage market is likely to experience substantial growth. The need for mobility and accessibility further enhances this trend, as users require solutions that can easily be transported and accessed on-the-go.

Rising E-commerce Activities

The expansion of e-commerce in South America is significantly influencing the portable data-storage market. As online shopping continues to grow, businesses require efficient data management systems to handle transactions, customer information, and inventory data. The portable data-storage market is poised to benefit from this trend, as companies seek reliable storage solutions to support their operations. In 2025, e-commerce sales in the region are expected to surpass $100 billion, driving the need for robust data storage options. This growth creates opportunities for portable data-storage devices that can securely store sensitive information while ensuring quick access for business operations.

Evolving Consumer Preferences

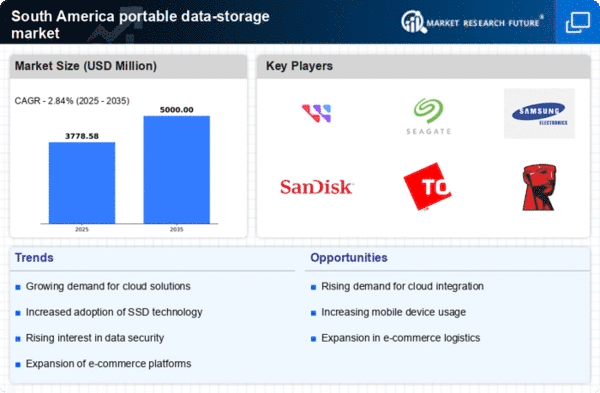

Consumer preferences in South America are shifting towards portable and user-friendly data-storage solutions. As lifestyles become increasingly mobile, individuals and businesses are seeking storage options that offer convenience and flexibility. The portable data-storage market is responding to this demand by introducing innovative products that cater to the needs of tech-savvy consumers. For example, the rise of cloud storage services has led to a hybrid approach, where users prefer a combination of physical and cloud-based storage. This trend is reflected in the growing sales of portable SSDs and USB drives, which are projected to increase by 15% annually. The emphasis on ease of use and portability is likely to shape product development in the industry.

Focus on Data Backup and Recovery Solutions

The growing awareness of data loss risks is driving the demand for backup and recovery solutions in South America. As businesses and individuals recognize the importance of safeguarding their data, the portable data-storage market is experiencing heightened interest in products that offer reliable backup options. The increasing frequency of cyber threats and data breaches has made data security a priority. Consequently, portable data-storage devices that provide encryption and secure backup features are becoming essential. The market for these solutions is projected to grow by 20% annually, as users seek to protect their valuable information from potential loss.

Government Initiatives for Digital Transformation

Government initiatives aimed at promoting digital transformation in South America are acting as a catalyst for the portable data-storage market. Various countries in the region are investing in technology infrastructure to enhance connectivity and digital services. These initiatives often include support for small and medium-sized enterprises (SMEs) to adopt digital tools, which in turn increases the demand for portable data-storage solutions. The portable data-storage market is likely to see growth as businesses seek to comply with new regulations and leverage technology for efficiency. As governments push for a more digital economy, the need for reliable and portable data storage will become increasingly critical.