Increasing Aging Population

The aging population in South America is a crucial driver for the retinal drugs market. As individuals age, the prevalence of age-related retinal diseases, such as age-related macular degeneration (AMD) and diabetic retinopathy, tends to rise. It is estimated that by 2030, the population aged 60 and above in South America will reach approximately 20% of the total population. This demographic shift is likely to increase the demand for effective retinal treatments, thereby propelling the market forward. Furthermore, the growing awareness of eye health among older adults may lead to earlier diagnosis and treatment, which could further stimulate market growth. The retinal drugs market must adapt to these demographic changes by developing targeted therapies that cater to the specific needs of this aging population.

Rising Healthcare Expenditure

In South America, increasing healthcare expenditure is a significant driver for the retinal drugs market. Governments and private sectors are investing more in healthcare infrastructure, which includes the development and distribution of retinal drugs. According to recent data, healthcare spending in South America is expected to reach approximately $500 billion by 2025, reflecting a growth rate of around 5% annually. This increase in funding is likely to enhance access to advanced retinal treatments and improve patient care. Moreover, as healthcare systems evolve, there is a growing emphasis on preventive care and early intervention, which could lead to higher demand for retinal drugs. The retinal drugs market stands to benefit from this trend, as more resources are allocated to combat retinal diseases and improve overall eye health.

Growing Awareness and Education

The growing awareness and education regarding retinal diseases in South America are pivotal drivers for the retinal drugs market. Public health campaigns and educational initiatives are increasingly informing the population about the importance of eye health and the risks associated with untreated retinal conditions. This heightened awareness is likely to lead to earlier diagnosis and treatment, which could significantly impact the market. Furthermore, healthcare professionals are becoming more adept at recognizing and managing retinal diseases, contributing to improved patient outcomes. As awareness continues to rise, the demand for effective retinal drugs is expected to increase, thereby propelling the market forward. The retinal drugs market must capitalize on this trend by ensuring that healthcare providers are equipped with the latest information and treatment options.

Expansion of Distribution Channels

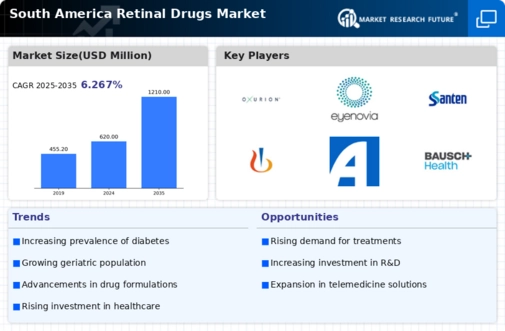

The expansion of distribution channels in South America is an essential driver for the retinal drugs market. As pharmaceutical companies seek to enhance their market presence, they are increasingly focusing on establishing robust distribution networks. This includes partnerships with local distributors, pharmacies, and healthcare facilities to ensure that retinal drugs are readily available to patients. The rise of e-commerce platforms is also transforming the way medications are accessed, making it easier for patients to obtain necessary treatments. With the market projected to grow at a CAGR of approximately 7% over the next five years, the expansion of distribution channels is likely to play a crucial role in meeting the increasing demand for retinal drugs. By improving accessibility, the retinal drugs market can better serve patients and healthcare providers alike.

Technological Innovations in Treatment

Technological advancements in the retinal drugs market are driving significant changes in treatment options available to patients. Innovations such as gene therapy, sustained-release drug delivery systems, and novel pharmacological agents are emerging as potential solutions for retinal diseases. For instance, the introduction of intravitreal injections has revolutionized the treatment landscape, allowing for targeted delivery of drugs directly to the retina. The market for retinal drugs is projected to grow at a CAGR of around 8% from 2025 to 2030, driven by these technological innovations. Additionally, the integration of artificial intelligence in diagnostics and treatment planning is expected to enhance patient outcomes, further boosting the market. As these technologies continue to evolve, they may lead to more effective and personalized treatment options, thereby expanding the retinal drugs market.