Automotive Industry Resilience

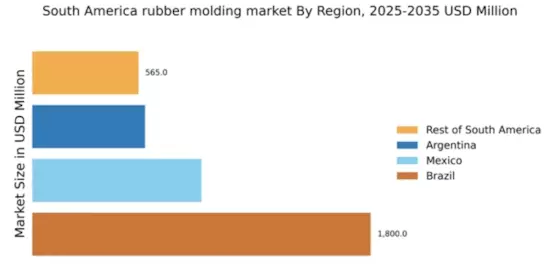

Despite fluctuations in the economy, the automotive industry in South America remains resilient, which positively impacts the rubber molding market. The demand for rubber parts in vehicles, such as tires, seals, and hoses, continues to grow as automotive production stabilizes. Countries like Brazil are witnessing a resurgence in vehicle manufacturing, with an expected increase in production by 3% in the coming year. This growth in the automotive sector is likely to bolster the rubber molding market, as manufacturers seek to supply high-quality rubber components to meet the needs of automakers. The integration of advanced materials and technologies in automotive design may also enhance the demand for specialized rubber products, further driving market growth.

Rising Demand for Consumer Goods

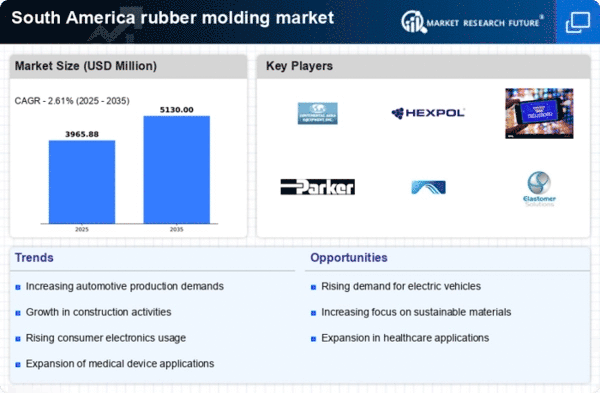

The rubber molding market in South America is experiencing a notable increase in demand for consumer goods, which is driving growth in the industry. As disposable incomes rise, consumers are seeking a variety of products that utilize rubber components, such as household items, toys, and personal care products. This trend is particularly evident in countries like Brazil and Argentina, where the middle class is expanding. The rubber molding market is projected to grow at a CAGR of approximately 5.5% over the next five years, reflecting the increasing consumption of rubber-based products. Manufacturers are responding by enhancing production capabilities to meet this growing demand, thereby contributing to the overall expansion of the rubber molding market in the region.

Growth in Renewable Energy Sector

The rubber molding market in South America is likely to benefit from the growth of the renewable energy sector. As countries in the region, such as Chile and Brazil, invest in solar and wind energy, the demand for rubber components used in energy systems is increasing. Rubber is essential for various applications, including seals and insulation in energy equipment. The rubber molding market is projected to expand as renewable energy projects proliferate, potentially leading to a market growth rate of 4.5% over the next few years. This trend indicates a shift towards sustainable energy solutions, which may further drive innovation in rubber molding technologies to meet the specific needs of the energy sector.

Infrastructure Development Projects

Infrastructure development is a significant driver for the rubber molding market in South America. Governments are investing heavily in infrastructure projects, including transportation, energy, and urban development. This investment leads to an increased demand for rubber components used in construction materials, seals, and gaskets. For instance, Brazil's ongoing infrastructure initiatives are expected to require substantial quantities of rubber products, thereby boosting the rubber molding market. The market is anticipated to witness a growth rate of around 6% annually as these projects progress. Additionally, the focus on improving public transportation systems and road networks further enhances the demand for durable rubber products, solidifying the industry's position in the regional economy.

Technological Innovations in Manufacturing

Technological innovations are transforming the rubber molding market in South America, leading to enhanced production efficiency and product quality. The adoption of advanced manufacturing techniques, such as automation and 3D printing, is enabling companies to produce complex rubber components with greater precision. This shift is particularly relevant in industries such as aerospace and medical devices, where high-performance rubber products are essential. The rubber molding market is expected to see a growth rate of approximately 5% as manufacturers invest in new technologies to improve their competitive edge. Furthermore, these innovations may lead to reduced production costs and shorter lead times, making the rubber molding market more attractive to potential investors and customers.