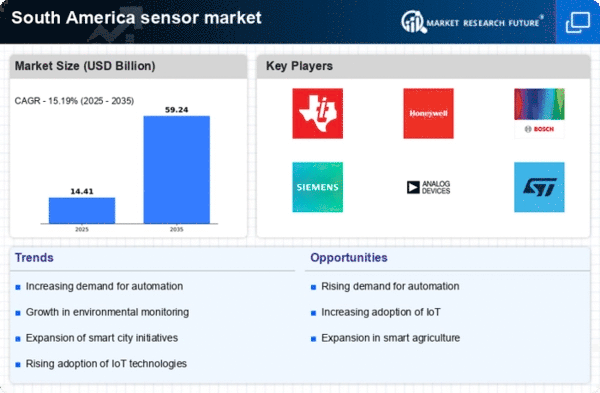

Rising Demand for Automation in Industries

The sensor market in South America is experiencing a notable surge in demand for automation across various industries. This trend is driven by the need for enhanced efficiency and productivity. Industries such as manufacturing, agriculture, and logistics are increasingly integrating sensors to monitor processes and optimize operations. For instance, the adoption of sensors in agricultural practices has been reported to improve yield by up to 30%. As companies seek to reduce operational costs and improve quality control, the sensor market is likely to benefit significantly from this shift towards automation.

Advancements in Wireless Sensor Technologies

The evolution of wireless sensor technologies is significantly impacting the sensor market in South America. The proliferation of wireless communication protocols, such as LoRa and Zigbee, is enabling the deployment of sensors in remote and hard-to-reach areas. This advancement is particularly beneficial for sectors like agriculture and environmental monitoring, where real-time data collection is essential. The market for wireless sensors is projected to grow at a CAGR of 15% over the next five years, indicating a robust demand for innovative sensor solutions that leverage wireless capabilities.

Increasing Investment in Smart Infrastructure

Investment in smart infrastructure is a key driver for the sensor market in South America. As urbanization accelerates, cities are increasingly adopting smart technologies to improve urban living conditions. This includes the integration of sensors in traffic management systems, waste management, and energy efficiency initiatives. For instance, smart traffic lights equipped with sensors can reduce congestion by up to 20%. The projected investment in smart city projects in South America is expected to exceed $50 billion by 2030, creating a fertile ground for sensor market growth.

Growing Focus on Health and Safety Regulations

The sensor market in South America is increasingly influenced by the growing emphasis on health and safety regulations across various sectors. Industries such as food and beverage, pharmaceuticals, and construction are adopting sensors to ensure compliance with stringent safety standards. For instance, the implementation of temperature and humidity sensors in food storage facilities is becoming a norm to prevent spoilage and ensure quality. This heightened focus on safety is expected to propel the demand for sensors, as companies strive to meet regulatory requirements and enhance consumer trust.

Government Initiatives Supporting Technological Advancements

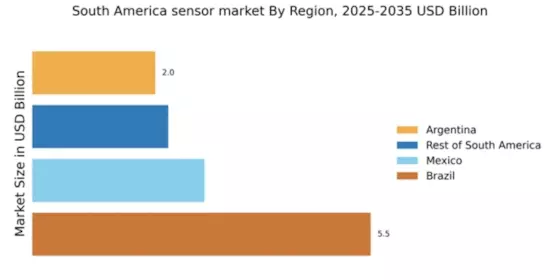

In South America, government initiatives aimed at fostering technological advancements are playing a crucial role in the growth of the sensor market. Various countries are implementing policies that encourage research and development in sensor technologies. For example, Brazil's investment in smart infrastructure projects is expected to reach $10 billion by 2026, which will likely create substantial opportunities for sensor manufacturers. These initiatives not only promote innovation but also enhance the competitiveness of local industries, thereby driving the demand for advanced sensor solutions.