Emergence of Personalized Medicine

The shift towards personalized medicine in South America is creating new opportunities for the smart biosensors market. As healthcare moves away from a one-size-fits-all approach, the demand for tailored treatment solutions is growing. Smart biosensors play a crucial role in this transformation by providing real-time data that can be used to customize therapies based on individual patient needs. This trend is supported by a growing body of research indicating that personalized treatment can improve patient outcomes by up to 30%. Consequently, the smart biosensors market is likely to expand as healthcare providers increasingly adopt these technologies to enhance personalized care.

Increased Focus on Preventive Healthcare

The rising awareness of preventive healthcare in South America is driving the smart biosensors market. As populations become more health-conscious, there is a growing emphasis on early detection and prevention of diseases. Smart biosensors facilitate this shift by enabling continuous monitoring of health parameters, which can lead to timely interventions. Recent surveys indicate that over 60% of South Americans are now prioritizing preventive measures, creating a fertile ground for the adoption of biosensing technologies. This trend is expected to propel the smart biosensors market forward, as more individuals seek proactive health management solutions.

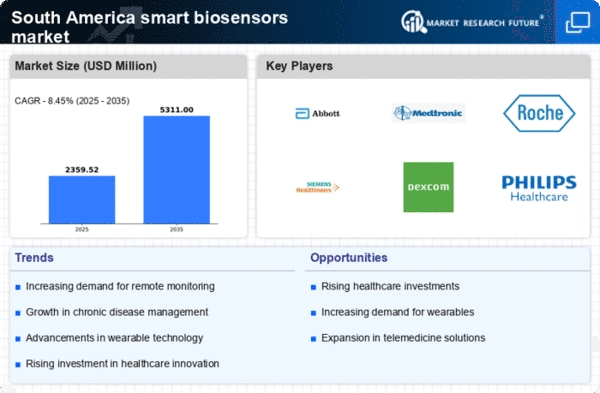

Rising Demand for Remote Patient Monitoring

The increasing prevalence of chronic diseases in South America is driving the demand for remote patient monitoring solutions. Smart biosensors market is witnessing a surge as healthcare providers seek efficient ways to monitor patients outside traditional clinical settings. According to recent estimates, the chronic disease burden in the region is projected to rise by 25% over the next decade, necessitating innovative monitoring solutions. Smart biosensors enable real-time data collection, allowing healthcare professionals to make informed decisions promptly. This shift towards remote monitoring not only enhances patient outcomes but also reduces healthcare costs, making it a pivotal driver for the smart biosensors market.

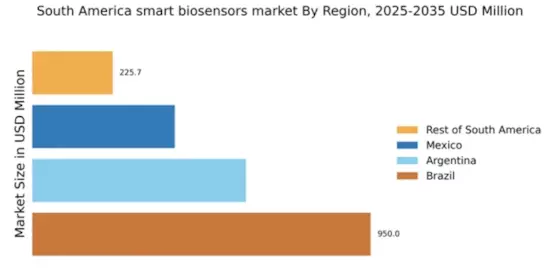

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is significantly impacting the smart biosensors market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, which includes the integration of advanced technologies. For instance, Brazil and Argentina have announced multi-million dollar initiatives aimed at modernizing healthcare systems. This investment is expected to increase the adoption of smart biosensors, as healthcare providers look to leverage technology for improved diagnostics and patient care. The smart biosensors market is likely to benefit from this trend, as enhanced infrastructure facilitates the deployment of innovative biosensing technologies.

Advancements in Wireless Communication Technologies

Advancements in wireless communication technologies are significantly influencing the smart biosensors market in South America. The proliferation of 5G networks is enhancing the capabilities of smart biosensors, allowing for faster data transmission and improved connectivity. This technological evolution is crucial for applications that require real-time monitoring and immediate feedback, such as in chronic disease management. As connectivity improves, the adoption of smart biosensors is likely to increase, with market analysts projecting a growth rate of approximately 20% annually in the coming years. This trend underscores the importance of robust communication infrastructure in driving the smart biosensors market.