Expansion of Internet Connectivity

The software as-a-service market in South America is significantly influenced by the expansion of internet connectivity across the region. Improved access to high-speed internet enables more businesses to adopt cloud-based solutions, which are essential for SaaS applications. As of 2025, internet penetration in South America has reached approximately 75%, facilitating a conducive environment for the software as-a-service market to thrive. Enhanced connectivity not only supports the deployment of SaaS solutions but also encourages innovation and the development of new applications tailored to local needs, further propelling market growth.

Increased Focus on Cost Efficiency

In South America, the software as-a-service market is witnessing a heightened emphasis on cost efficiency among businesses. Organizations are increasingly turning to SaaS solutions to reduce operational costs associated with traditional software licensing and maintenance. By leveraging subscription-based models, companies can allocate resources more effectively, allowing for better financial management. Reports indicate that businesses can save up to 30% on IT expenditures by transitioning to SaaS platforms. This trend reflects a broader movement towards optimizing budgets while still accessing high-quality software solutions, thereby driving growth within the software as-a-service market.

Growing Demand for Remote Work Solutions

The software as-a-service market in South America experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for cloud-based collaboration tools becomes paramount. This shift is evidenced by a reported growth rate of approximately 25% in the adoption of remote work software in the region. Companies are seeking solutions that facilitate communication, project management, and file sharing, all of which are integral to maintaining productivity in a remote environment. The software as-a-service market is thus positioned to benefit from this trend, as businesses prioritize tools that enhance remote collaboration and streamline workflows.

Emphasis on Customization and Scalability

The software as-a-service market in South America is characterized by a growing emphasis on customization and scalability. Businesses are seeking SaaS solutions that can be tailored to their specific needs, allowing for greater flexibility in operations. This trend is particularly evident among small and medium-sized enterprises (SMEs) that require scalable solutions to accommodate growth. Reports suggest that approximately 60% of SMEs in the region prioritize customizable software options. As a result, SaaS providers are increasingly focusing on offering modular solutions that can adapt to varying business requirements, thereby enhancing their appeal in the competitive software as-a-service market.

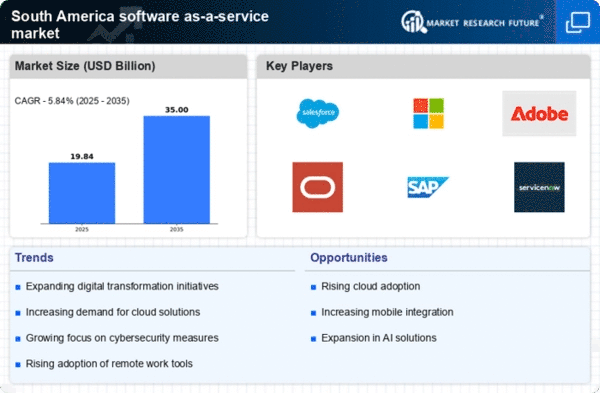

Rising Interest in Digital Transformation

Digital transformation initiatives are gaining momentum in South America, driving the software as-a-service market forward. Organizations are increasingly recognizing the need to modernize their operations and embrace digital technologies to remain competitive. This shift is reflected in a reported increase of around 40% in investments towards digital solutions, including SaaS applications. Companies are adopting these technologies to enhance customer experiences, streamline processes, and improve data analytics capabilities. As businesses embark on their digital transformation journeys, the demand for software as-a-service solutions is likely to continue its upward trajectory.