Advancements in Sports Technology

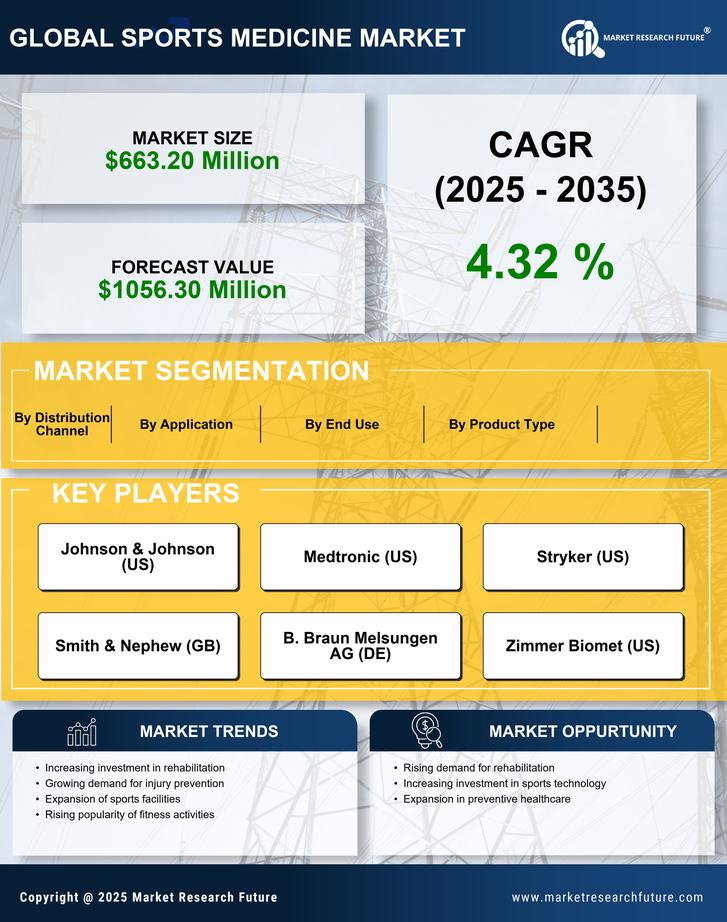

Technological innovations in sports equipment and training methodologies are significantly influencing the sports medicine market. The integration of wearable technology, such as fitness trackers and smart clothing, allows for real-time monitoring of athletes' health metrics. This data-driven approach enhances injury prevention and recovery strategies, thereby driving demand for sports medicine services. The sports medicine market is adapting to these advancements by offering specialized treatments that align with the latest technological trends. For instance, the use of telemedicine in sports rehabilitation is gaining traction, providing remote consultations and follow-ups. As technology continues to evolve, the market is expected to expand, with projections indicating a potential market size of $1.8 billion by 2027, driven by these innovations.

Government Initiatives and Funding

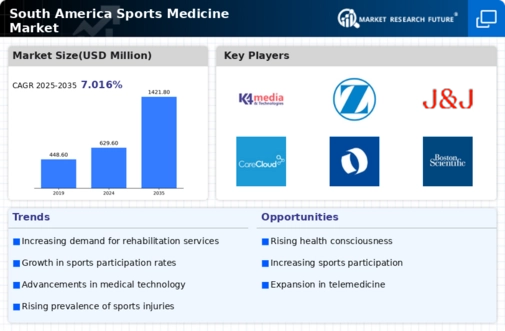

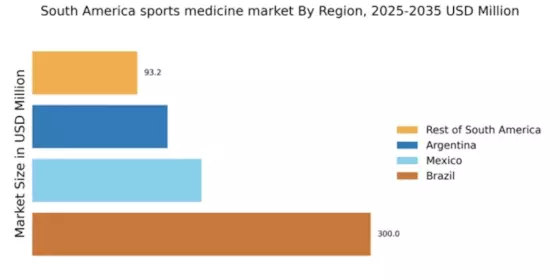

Government support for sports and health initiatives is a significant driver of the sports medicine market in South America. Various countries are investing in sports infrastructure and healthcare programs aimed at promoting physical activity and improving athlete health. These initiatives often include funding for sports medicine research, training for healthcare professionals, and the establishment of specialized clinics. The sports medicine market stands to gain from these investments, as they enhance the availability and quality of medical services for athletes. For instance, Brazil's government has allocated substantial resources to improve sports facilities and healthcare access, which is expected to bolster the market's growth. Projections indicate that such initiatives could contribute to a market expansion of around 6% over the next few years.

Increasing Participation in Sports

The growing interest in sports among the South American population is a key driver for the sports medicine market. As more individuals engage in various athletic activities, the demand for specialized medical services and products rises. This trend is particularly evident in countries like Brazil and Argentina, where sports culture is deeply ingrained. The sports medicine market is likely to benefit from this increased participation, as injuries become more prevalent, necessitating effective treatment and rehabilitation solutions. According to recent estimates, the sports medicine market in South America is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8% from 2021 to 2026. This growth underscores the importance of addressing the healthcare needs of active individuals.

Rise of Fitness and Wellness Trends

The increasing focus on fitness and wellness among the South American population is driving the sports medicine market. As more individuals prioritize health and physical activity, the demand for sports medicine services is likely to rise. This trend is reflected in the growing popularity of gyms, fitness classes, and wellness programs across the region. The sports medicine market is responding to this shift by offering tailored services that cater to fitness enthusiasts, including injury prevention workshops and personalized rehabilitation plans. Market analysis suggests that the sports medicine sector could see a growth trajectory of approximately 9% annually, as the emphasis on holistic health continues to gain momentum.

Growing Awareness of Sports Injuries

There is an increasing awareness of sports-related injuries among athletes and the general public in South America. This heightened consciousness is leading to a greater demand for preventive measures and treatment options within the sports medicine market. Educational campaigns and initiatives by sports organizations are playing a crucial role in informing individuals about the risks associated with physical activities. Consequently, the sports medicine market is witnessing a surge in the utilization of services such as physiotherapy, orthopedic consultations, and injury management programs. Reports suggest that the market could experience a growth rate of approximately 7% annually, as more individuals seek professional help to address and prevent injuries.