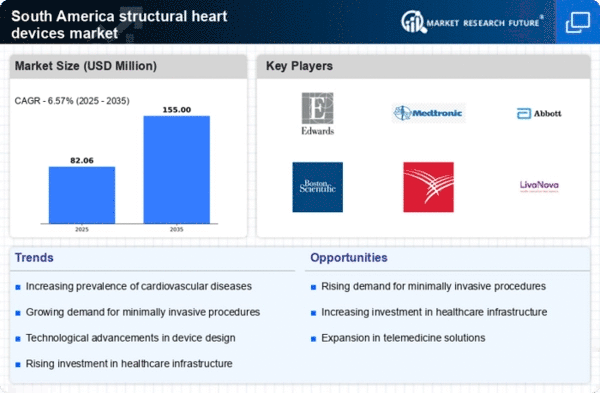

Brazil : Strong Growth and Innovation Hub

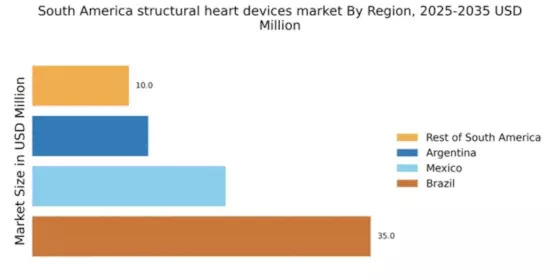

Brazil holds a commanding 35.0% market share in South America's structural heart-devices market, valued at approximately $1.5 billion. Key growth drivers include an aging population, increasing prevalence of cardiovascular diseases, and government initiatives aimed at improving healthcare access. Regulatory policies are becoming more favorable, with the National Health Surveillance Agency (ANVISA) streamlining approval processes for innovative devices, enhancing market dynamics. Infrastructure improvements in healthcare facilities further support demand trends, particularly in urban areas.

Key markets include São Paulo, Rio de Janeiro, and Brasília, where advanced healthcare infrastructure is concentrated. The competitive landscape features major players like Edwards Lifesciences, Medtronic, and Abbott Laboratories, all of which have established a strong presence. Local dynamics are characterized by a growing emphasis on minimally invasive procedures, with hospitals increasingly adopting advanced technologies. The business environment is bolstered by partnerships between local firms and international manufacturers, enhancing product availability and innovation.

Mexico : Rising Demand and Investment Opportunities

Mexico accounts for 20.0% of the structural heart-devices market in South America, valued at around $800 million. The market is driven by increasing healthcare investments, a growing middle class, and rising awareness of cardiovascular health. Demand trends indicate a shift towards advanced technologies, supported by government initiatives to enhance healthcare infrastructure. Regulatory frameworks are also improving, facilitating faster access to innovative devices for patients across the country.

Key markets include Mexico City, Guadalajara, and Monterrey, where healthcare facilities are rapidly modernizing. The competitive landscape features significant players like Boston Scientific and Medtronic, which are investing in local manufacturing. The business environment is favorable, with a growing number of partnerships between local hospitals and international firms. The focus on preventive care and early diagnosis is driving the adoption of structural heart devices, making Mexico a promising market for future growth.

Argentina : Emerging Opportunities in Healthcare

Argentina holds a 12.0% share of the structural heart-devices market in South America, valued at approximately $500 million. Key growth drivers include an increasing incidence of heart diseases and a rising demand for advanced medical technologies. Government initiatives aimed at improving healthcare access and affordability are also contributing to market expansion. Regulatory policies are evolving, with efforts to streamline the approval process for new devices, enhancing market entry for innovative solutions.

Key markets include Buenos Aires, Córdoba, and Mendoza, where healthcare facilities are increasingly adopting advanced technologies. The competitive landscape features major players like Abbott Laboratories and LivaNova, which are actively expanding their presence. Local market dynamics are characterized by a focus on public-private partnerships to enhance healthcare delivery. The business environment is improving, with increased investment in healthcare infrastructure and a growing emphasis on patient-centered care, creating opportunities for structural heart device manufacturers.

Rest of South America : Potential for Growth and Innovation

The Rest of South America accounts for 10.0% of the structural heart-devices market, valued at around $400 million. This sub-region includes countries like Chile, Colombia, and Peru, where the market is driven by increasing healthcare investments and a rising prevalence of cardiovascular diseases. Demand trends indicate a growing interest in minimally invasive procedures, supported by government initiatives to improve healthcare access. Regulatory frameworks are also evolving, facilitating the entry of innovative devices into these markets.

Key markets include Santiago, Bogotá, and Lima, where healthcare infrastructure is gradually improving. The competitive landscape features a mix of local and international players, including Terumo Corporation and JenaValve Technology, which are expanding their footprint. Local dynamics are characterized by varying levels of healthcare access and investment, creating unique challenges and opportunities. The business environment is becoming more favorable, with increasing collaboration between governments and private sectors to enhance healthcare delivery and innovation.

Leave a Comment