Government Initiatives and Funding

Government support and funding for research and development in the targeted liposomes-drug-delivery market are increasingly evident in South America. Various national health agencies are allocating resources to promote innovative drug delivery systems, recognizing their potential to improve patient outcomes. For example, Brazil's Ministry of Health has launched initiatives aimed at enhancing access to advanced therapies, which may include targeted liposomes. Such funding not only stimulates research but also encourages collaboration between academic institutions and pharmaceutical companies. This supportive environment is expected to foster advancements in drug delivery technologies, ultimately benefiting the market.

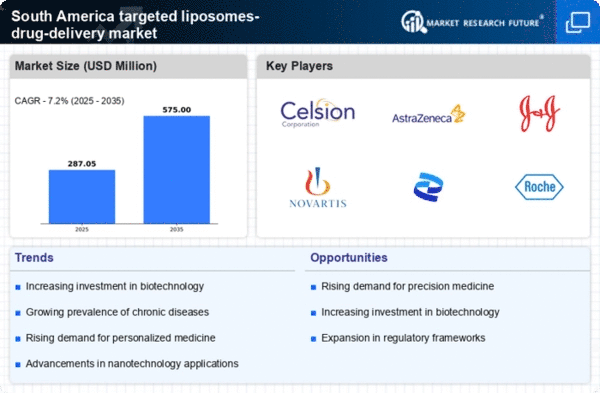

Growing Investment in Biotechnology

The surge in investment within the biotechnology sector in South America is a significant driver for the targeted liposomes-drug-delivery market. Investors are increasingly recognizing the potential of biopharmaceuticals and advanced drug delivery systems. In 2025, it is projected that investments in biotechnology in the region could exceed $5 billion, with a substantial portion directed towards innovative drug delivery solutions. This influx of capital is likely to accelerate the development of targeted liposomes, enhancing their application in various therapeutic areas. As a result, the market is expected to experience robust growth, driven by the demand for more effective and safer drug delivery methods.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South America is a crucial driver for the targeted liposomes-drug-delivery market. Conditions such as cancer, diabetes, and cardiovascular diseases are becoming more prevalent, necessitating innovative treatment options. The targeted liposomes-drug-delivery market is poised to benefit from this trend, as these delivery systems can enhance the efficacy of therapeutics while minimizing side effects. For instance, it is estimated that by 2025, the number of cancer cases in South America could reach 1.5 million, highlighting the urgent need for advanced drug delivery methods. This growing patient population is likely to drive demand for targeted therapies, thereby propelling the market forward.

Rising Awareness of Personalized Medicine

The growing awareness and acceptance of personalized medicine in South America are pivotal for the targeted liposomes-drug-delivery market. Patients and healthcare providers are increasingly seeking tailored treatment options that align with individual genetic profiles. This shift towards personalized approaches is likely to drive demand for targeted liposomes, which can deliver drugs more precisely to specific cells or tissues. As healthcare systems evolve to incorporate personalized medicine, the market for targeted drug delivery systems is expected to expand. By 2025, it is anticipated that personalized medicine could account for over 30% of total healthcare expenditures in the region, further propelling the market.

Technological Advancements in Drug Formulation

Technological innovations in drug formulation are significantly influencing the targeted liposomes-drug-delivery market in South America. Advances in nanotechnology and materials science are enabling the development of more efficient and stable liposomal formulations. These innovations are crucial for enhancing the bioavailability and therapeutic efficacy of drugs. As research progresses, it is expected that new formulation techniques will emerge, allowing for the creation of targeted liposomes that can overcome biological barriers. This evolution in drug formulation technology is likely to attract interest from pharmaceutical companies, thereby driving growth in the targeted liposomes-drug-delivery market.