Increasing Cancer Incidence Rates

The rising incidence of cancer in South America is a significant driver for the tissue microarray market. According to recent statistics, cancer cases are expected to increase by 25% in the next decade, necessitating advanced research tools for effective diagnosis and treatment. Tissue microarrays enable researchers to analyze multiple tumor samples simultaneously, providing insights into cancer biology and potential therapeutic targets. This growing need for efficient cancer research tools is likely to propel the tissue microarray market forward. As healthcare systems prioritize cancer research, investments in tissue microarray technologies are expected to rise, further solidifying the market's position in the region.

Rising Awareness of Precision Medicine

The tissue microarray market is benefiting from the rising awareness of precision medicine in South America. As healthcare providers and patients increasingly recognize the importance of tailored treatment approaches, the demand for technologies that facilitate personalized medicine is growing. Tissue microarrays play a vital role in this context by enabling the analysis of tumor heterogeneity and biomarker identification. This trend is expected to drive market growth, as healthcare systems invest in tools that support precision medicine initiatives. The potential for improved patient outcomes through targeted therapies is likely to further stimulate interest in tissue microarray technologies, positioning the market for continued expansion.

Advancements in Diagnostic Technologies

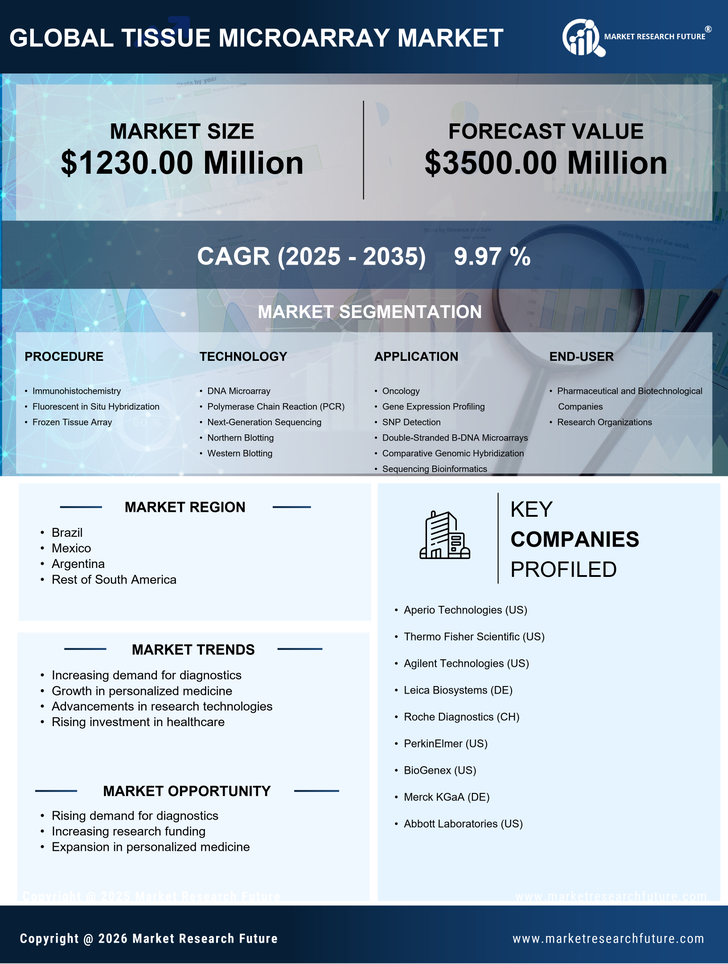

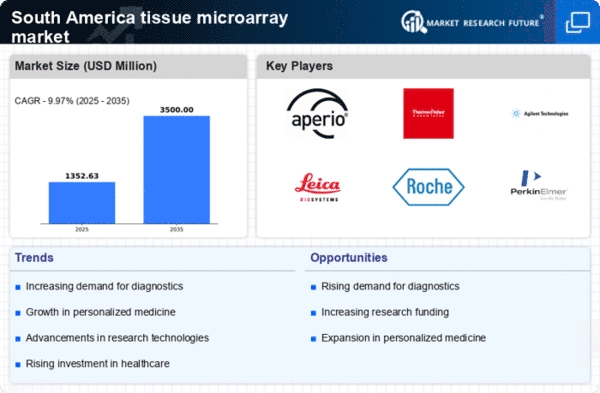

The tissue microarray market in South America is experiencing growth due to advancements in diagnostic technologies. Enhanced imaging techniques and automated analysis systems are improving the accuracy and efficiency of tissue analysis. These innovations allow for high-throughput screening of multiple samples simultaneously, which is crucial for research and clinical applications. The market is projected to grow at a CAGR of approximately 10% over the next five years, driven by the increasing adoption of these technologies in laboratories and hospitals. As diagnostic capabilities improve, the demand for tissue microarrays is likely to rise, facilitating better disease understanding and treatment options. This trend indicates a robust future for the tissue microarray market in the region.

Collaboration Between Academia and Industry

Collaboration between academic institutions and industry players is emerging as a key driver for the tissue microarray market in South America. Partnerships are fostering innovation and accelerating the development of new applications for tissue microarrays in research and clinical settings. These collaborations often lead to the sharing of resources, expertise, and funding, which can enhance the capabilities of tissue microarray technologies. As more joint ventures are established, the market is likely to see an increase in the availability of advanced tissue microarray products. This synergy between academia and industry is expected to create a dynamic environment for growth within the tissue microarray market.

Growing Investment in Biotechnology Research

Investment in biotechnology research is a crucial factor influencing the tissue microarray market in South America. Governments and private entities are increasingly funding research initiatives aimed at developing innovative diagnostic and therapeutic solutions. In 2025, it is estimated that biotechnology research funding will reach approximately $1 billion in the region, with a significant portion allocated to cancer research and personalized medicine. This influx of capital is likely to enhance the development and adoption of tissue microarray technologies, as researchers seek efficient methods to analyze biological samples. Consequently, the tissue microarray market is poised for growth as it becomes an integral part of the biotechnology research landscape.