Increased Fuel Costs

Fluctuating fuel prices are a critical driver for the transportation management-systems market in South America. As fuel costs rise, companies are compelled to seek ways to minimize operational expenses. Transportation management systems provide tools for route optimization and load planning, which can lead to significant fuel savings. In 2025, it is estimated that fuel costs could account for up to 30% of total logistics expenses, prompting businesses to adopt these systems to enhance efficiency and reduce costs. This trend indicates a growing reliance on technology to navigate the challenges posed by rising fuel prices.

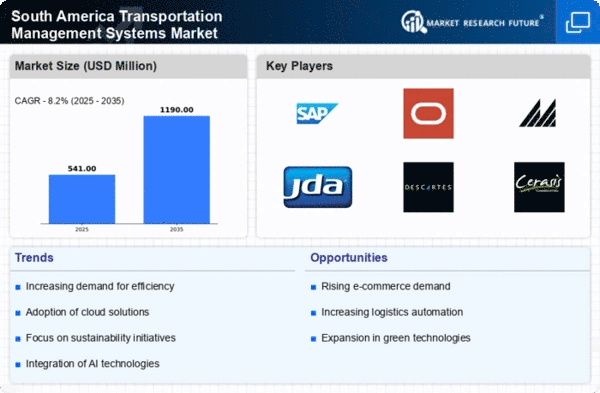

Rising E-commerce Demand

The surge in e-commerce activities across South America is driving the transportation management-systems market. As online shopping becomes increasingly popular, businesses require efficient logistics solutions to manage their supply chains effectively. In 2025, e-commerce sales in South America are projected to reach approximately $100 billion, necessitating advanced transportation management systems to handle the growing volume of shipments. Companies are investing in these systems to optimize routes, reduce delivery times, and enhance customer satisfaction. This trend indicates a robust demand for technology that can streamline operations and improve overall efficiency in the transportation sector.

Focus on Supply Chain Resilience

The need for supply chain resilience is increasingly influencing the transportation management-systems market in South America. Companies are recognizing the importance of having robust logistics solutions that can adapt to disruptions. In 2025, it is anticipated that businesses will invest heavily in technology to enhance their supply chain visibility and responsiveness. Transportation management systems are essential for providing real-time data and analytics, enabling companies to make informed decisions during unforeseen circumstances. This focus on resilience suggests a shift towards more sophisticated systems that can withstand market fluctuations and operational challenges.

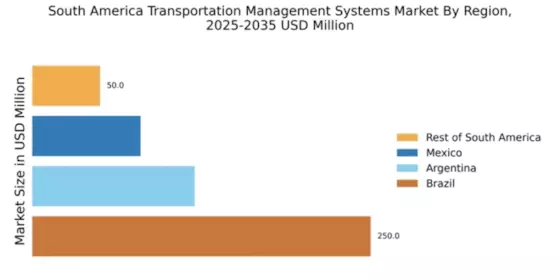

Urbanization and Infrastructure Development

Rapid urbanization in South America is significantly impacting the transportation management-systems market. As cities expand, the need for efficient transportation networks becomes paramount. Urban areas are experiencing increased traffic congestion, which necessitates the implementation of advanced transportation management systems to optimize logistics. In 2025, urban populations in South America are expected to exceed 80% of the total population, leading to a greater demand for innovative solutions that can manage urban freight effectively. This trend suggests that transportation management systems will play a crucial role in addressing the challenges posed by urban growth and infrastructure development.

Government Investment in Transportation Infrastructure

Government initiatives aimed at improving transportation infrastructure are significantly impacting the transportation management-systems market in South America. Increased public spending on roads, ports, and railways is expected to enhance logistics capabilities across the region. In 2025, government investments in infrastructure are projected to exceed $50 billion, creating opportunities for transportation management systems to integrate with new developments. This trend indicates that as infrastructure improves, the demand for advanced management systems will likely rise, facilitating smoother operations and better connectivity within the transportation network.